Question: Answer if the statements are true or false, and clearly outline your reasoning: a) Suppose that: (i) stock A has higher return and lower

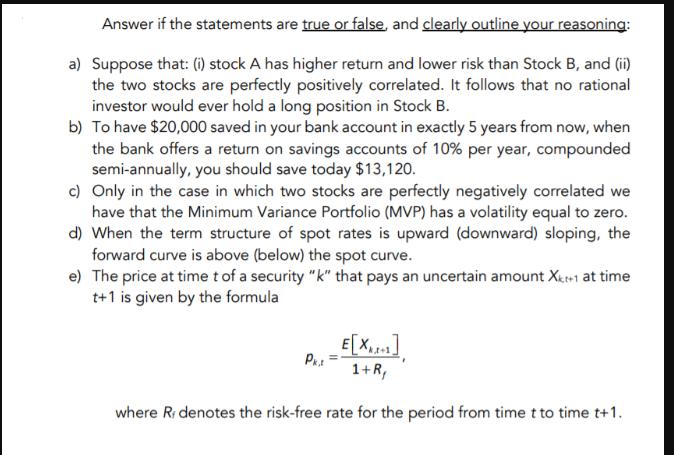

Answer if the statements are true or false, and clearly outline your reasoning: a) Suppose that: (i) stock A has higher return and lower risk than Stock B, and (ii) the two stocks are perfectly positively correlated. It follows that no rational investor would ever hold a long position in Stock B. b) To have $20,000 saved in your bank account in exactly 5 years from now, when the bank offers a return on savings accounts of 10% per year, compounded semi-annually, you should save today $13,120. c) Only in the case in which two stocks are perfectly negatively correlated we have that the Minimum Variance Portfolio (MVP) has a volatility equal to zero. d) When the term structure of spot rates is upward (downward) sloping, the forward curve is above (below) the spot curve. e) The price at time t of a security "k" that pays an uncertain amount X+1 at time t+1 is given by the formula _E[X.101] 1+R, where R, denotes the risk-free rate for the period from time t to time t+1. Pkt

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below a False Even though Stock A has higher ... View full answer

Get step-by-step solutions from verified subject matter experts