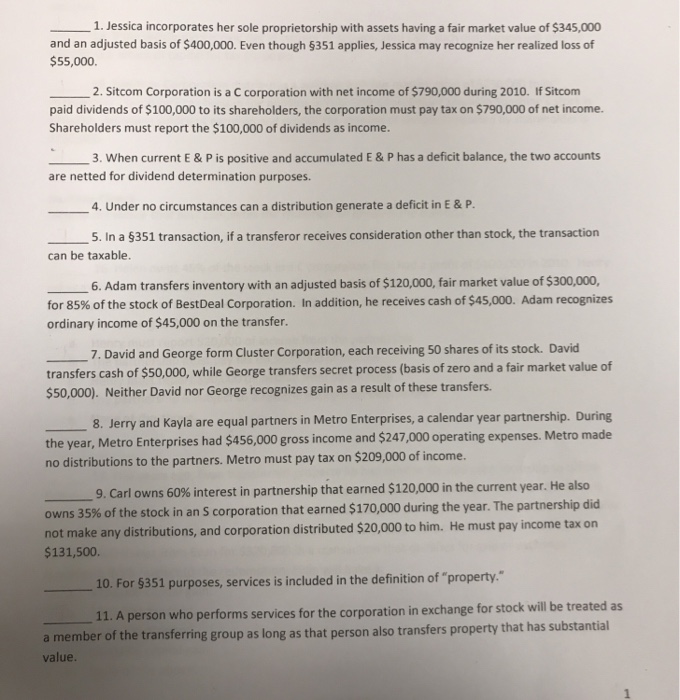

Question: Answer in a True or False form. Thank you 1. Jessica incorporates her sole proprietorship with assets having a fair market value of $345,000 and

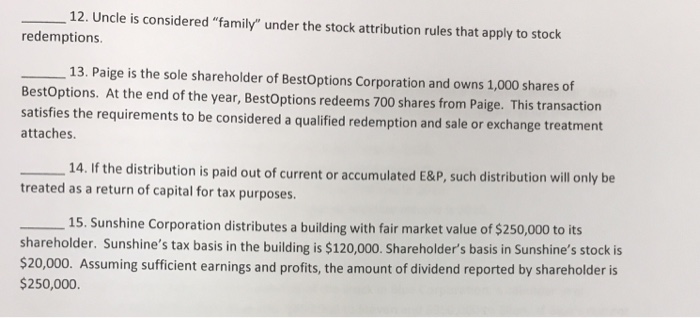

1. Jessica incorporates her sole proprietorship with assets having a fair market value of $345,000 and an adjusted basis of $400,000. Even though 351 applies, Jessica may recognize her realized loss of $55,000 2. Sitcom Corporation is a C corporation with net income of $790,000 during 2010. If Sitcom paid dividends of $100,000 to its shareholders, the corporation must pay tax on $790,000 of net income. Shareholders must report the $100,000 of dividends as income. 3. When current E & P is positive and accumulated E & P has a deficit balance, the two accounts are netted for dividend determination purposes. 4. Under no circumstances can a distribution generate a deficit in E & P 5. In a 5351 transaction, if a transferor receives consideration other than stock, the transaction can be taxable. 6. Adam transfers inventory with an adjusted basis of $120,000, fair market value of $300,000, for 85% of the stock of Best Deal Corporation. In addition, he receives cash of $45,000. Adam recognizes ordinary income of $45,000 on the transfer. 7. David and George form Cluster Corporation, each receiving 50 shares of its stock. David transfers cash of $50,000, while George transfers secret process (basis of zero and a fair market value of S50,000). Neither David nor George reco gnizes gain as a result of these transfers. 8. Jerry and Kayla are equal partners in Metro Enterprises, a calendar year partnership. During the year, Metro Enterprises had $456,000 gross income and $247,000 operating expenses. Metro made no distributions to the partners. Metro must pay tax on $209,000 of income. 9, Carl owns 60% interest in partnership that earned $120,000 in the current year. He also owns 35% of the stock in an S corporation that earned $170,000 during the year. The partnership did not make any distributions, and corporation distributed $20,000 to him. He must pay income tax on $131,500 51 purposes, services is included in the definition of "property who performs services for the corporation in exchange for stock will be treated as a member of th e transferring group as long as that person also transfers property that has substantial value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts