Question: ANSWER IN BOLD 25 22 Consider a project with a life of 7 years with the following information: initial fixed asset investment = $490,000; straight-line

ANSWER IN BOLD 25

22

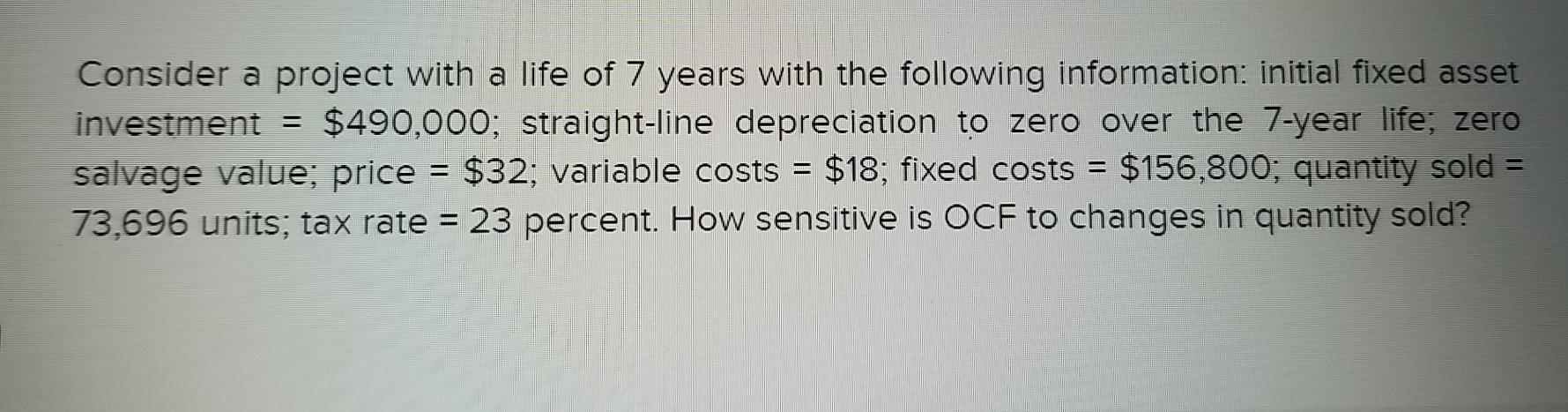

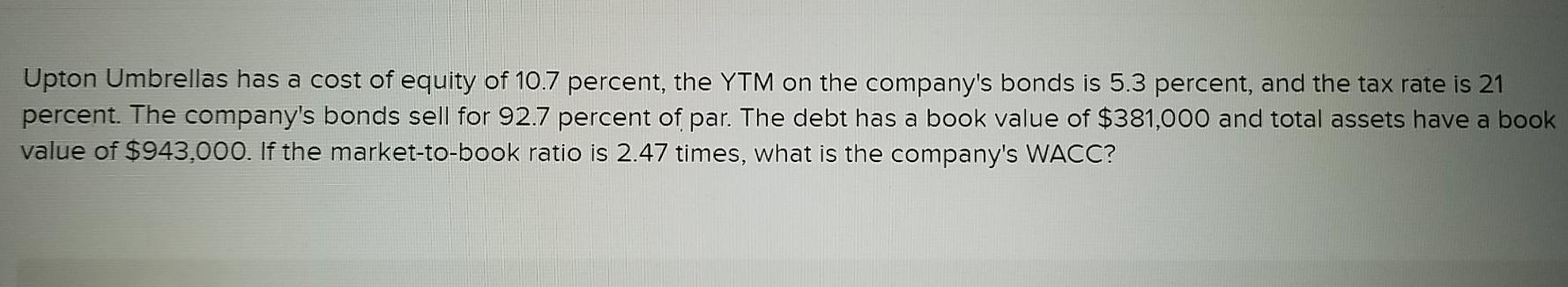

Consider a project with a life of 7 years with the following information: initial fixed asset investment = $490,000; straight-line depreciation to zero over the 7-year life; zero salvage value; price = $32; variable costs = $18; fixed costs = $156,800; quantity sold = 73,696 units, tax rate = 23 percent. How sensitive is OCF to changes in quantity sold? Upton Umbrellas has a cost of equity of 10.7 percent, the YTM on the company's bonds is 5.3 percent, and the tax rate is 21 percent. The company's bonds sell for 92.7 percent of par. The debt has a book value of $381,000 and total assets have a book value of $943,000. If the market-to-book ratio is 2.47 times, what is the company's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts