Question: ANSWER IN BOLD 28 10 A 6-year project is expected to generate annual sales of 9,700 units at a price of $84 per unit and

ANSWER IN BOLD 28

10

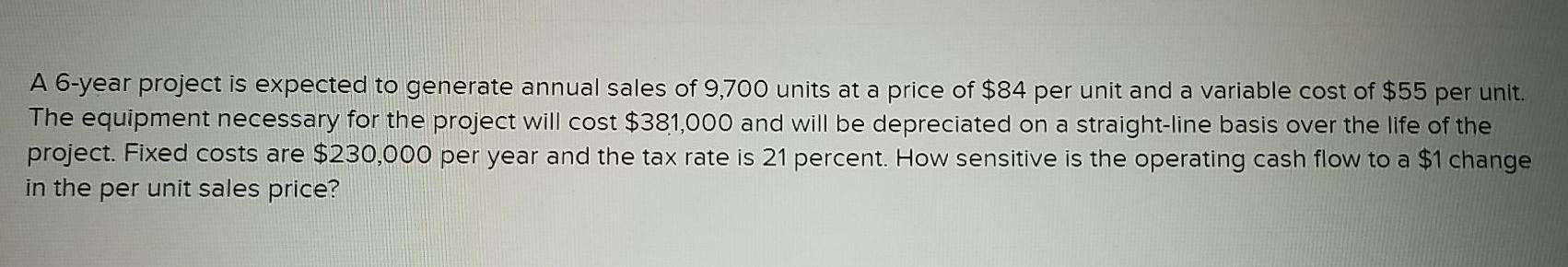

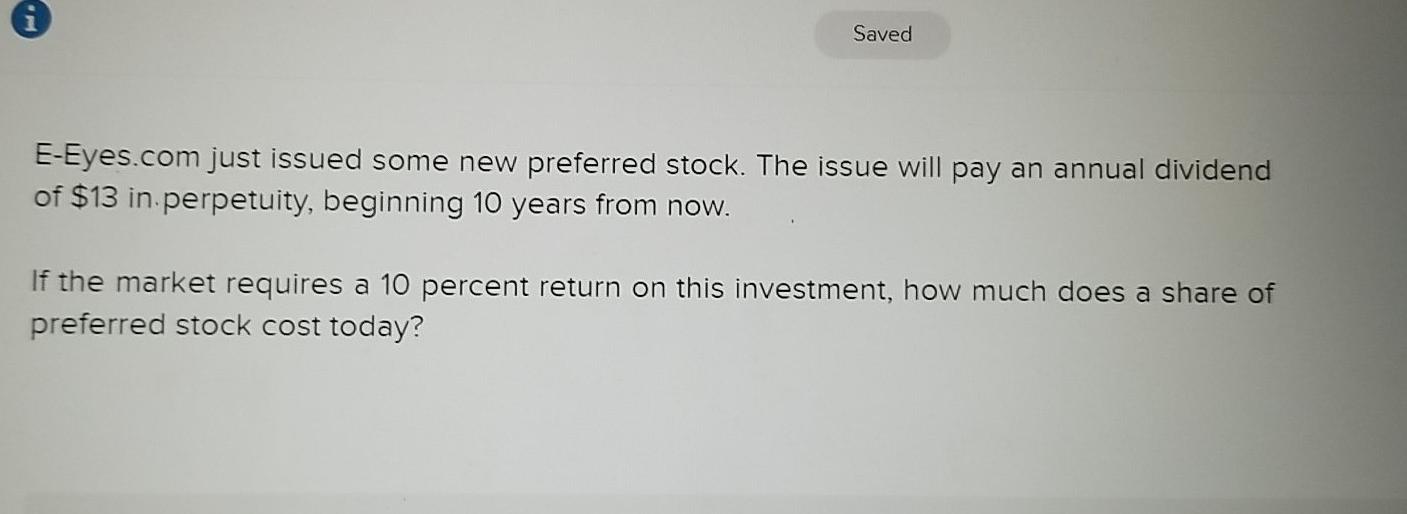

A 6-year project is expected to generate annual sales of 9,700 units at a price of $84 per unit and a variable cost of $55 per unit. The equipment necessary for the project will cost $381,000 and will be depreciated on a straight-line basis over the life of the project. Fixed costs are $230,000 per year and the tax rate is 21 percent. How sensitive is the operating cash flow to a $1 change in the per unit sales price? Saved E-Eyes.com just issued some new preferred stock. The issue will pay an annual dividend of $13 in perpetuity, beginning 10 years from now. If the market requires a 10 percent return on this investment, how much does a share of preferred stock cost today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts