Question: Answer in Excel. 3. Loan amortization ( 25 points) Suppose Robert obtained a home mortgage loan from Wells Fargo Bank on September 1,2018 . The

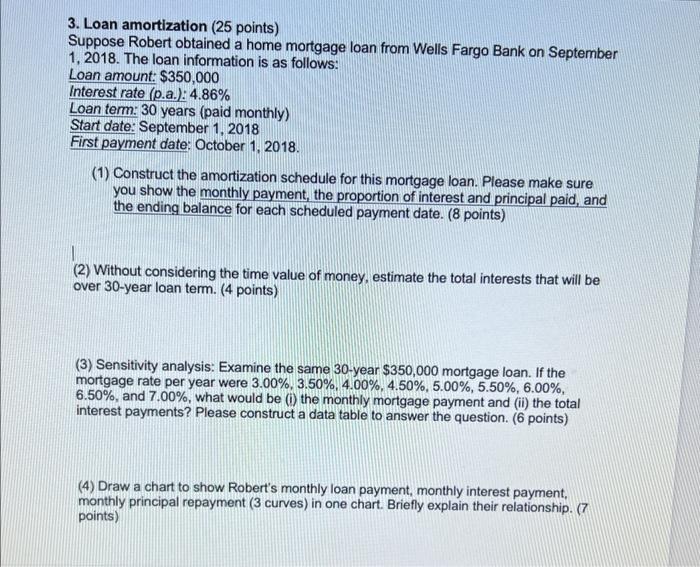

3. Loan amortization ( 25 points) Suppose Robert obtained a home mortgage loan from Wells Fargo Bank on September 1,2018 . The loan information is as follows: Loan amount: $350,000 Interest rate (p.a.): 4.86% Loan term: 30 years (paid monthly) Start date: September 1, 2018 First payment date: October 1, 2018. (1) Construct the amortization schedule for this mortgage loan. Please make sure you show the monthly payment, the proportion of interest and principal paid, and the ending balance for each scheduled payment date. (8 points) (2) Without considering the time value of money, estimate the total interests that will be over 30 -year loan term. (4 points) (3) Sensitivity analysis: Examine the same 30-year $350,000 mortgage loan. If the mortgage rate per year were 3.00%,3.50%,4.00%,4.50%,5.00%,5.50%,6.00%, 6.50%, and 7.00%, what would be (i) the monthly mortgage payment and (ii) the total interest payments? Please construct a data table to answer the question. (6 points) (4) Draw a chart to show Robert's monthly loan payment, monthly interest payment, monthly principal repayment ( 3 curves) in one chart. Briefly explain their relationship. (7 points) 3. Loan amortization ( 25 points) Suppose Robert obtained a home mortgage loan from Wells Fargo Bank on September 1,2018 . The loan information is as follows: Loan amount: $350,000 Interest rate (p.a.): 4.86% Loan term: 30 years (paid monthly) Start date: September 1, 2018 First payment date: October 1, 2018. (1) Construct the amortization schedule for this mortgage loan. Please make sure you show the monthly payment, the proportion of interest and principal paid, and the ending balance for each scheduled payment date. (8 points) (2) Without considering the time value of money, estimate the total interests that will be over 30 -year loan term. (4 points) (3) Sensitivity analysis: Examine the same 30-year $350,000 mortgage loan. If the mortgage rate per year were 3.00%,3.50%,4.00%,4.50%,5.00%,5.50%,6.00%, 6.50%, and 7.00%, what would be (i) the monthly mortgage payment and (ii) the total interest payments? Please construct a data table to answer the question. (6 points) (4) Draw a chart to show Robert's monthly loan payment, monthly interest payment, monthly principal repayment ( 3 curves) in one chart. Briefly explain their relationship. (7 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts