Question: answer in Excel format Obj. 2 PR 9-38 Depreciation by three methods; partial years 00 Layton Company purchased tool sharpening equipment on October 1 for

answer in Excel format

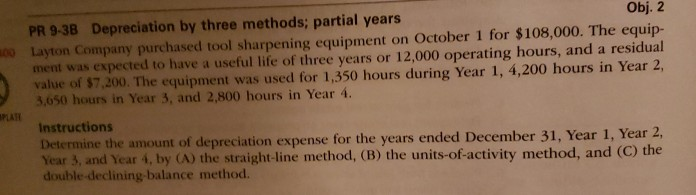

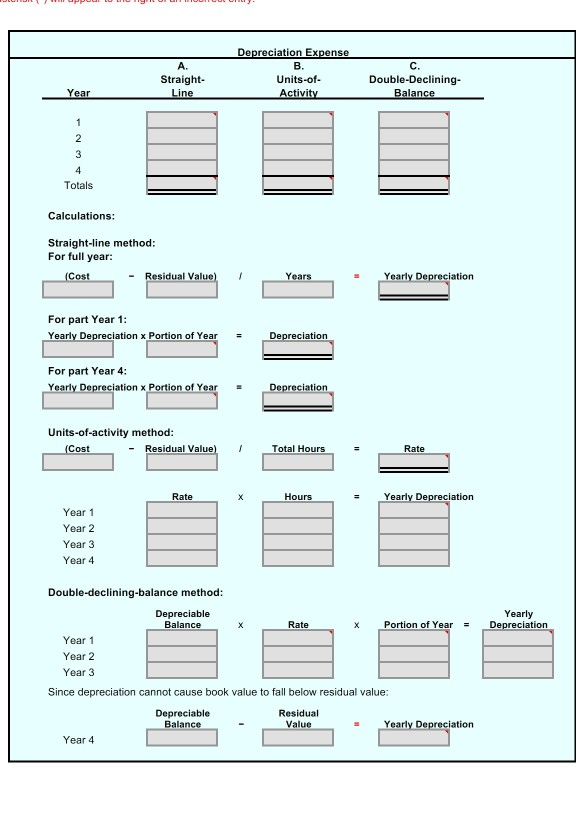

Obj. 2 PR 9-38 Depreciation by three methods; partial years 00 Layton Company purchased tool sharpening equipment on October 1 for $108,000. The equip- ment was expected to have a useful life of three years or 12,000 operating hours, and a residual value of $7,200. The equipment was used for 1,350 hours during Year 1, 4,200 hours in Year 2, 3,650 hours in Year 3, and 2,800 hours in Year 4. Instructions Determine the amount of depreciation expense for the years ended December 31, Y Year 3, and Year 4, by (A) the straight-line method, (B) the units-of-activity method, and (C) the double-declining-balance method. ear 1, Year 2, Depreciation Expense A. Straight- Double-Declining- Units-of- Totals Calculations: Straight-line method For full year: -Residual Value Yearly Depreciation For part Year 1: Ye De ciation x Portion of Year ciation For part Year 4: ciation x Portion of Year Units-of-activity method: -Residual Value) I Total Hours Rate Rate Hours Year 1 Year 2 Year 3 Year 4 Double-declining-balance method Yearly Balance Rate Portion of YearD ciation Year 1 Year 2 Year 3 Since depreciation cannot cause book value to fall below residual value Residual Value Balance Year 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts