Question: answer in excel format with all formulas please Carolyn's Outdoors makes tents for camping. She sells to wholesalers in large quantities at a price of

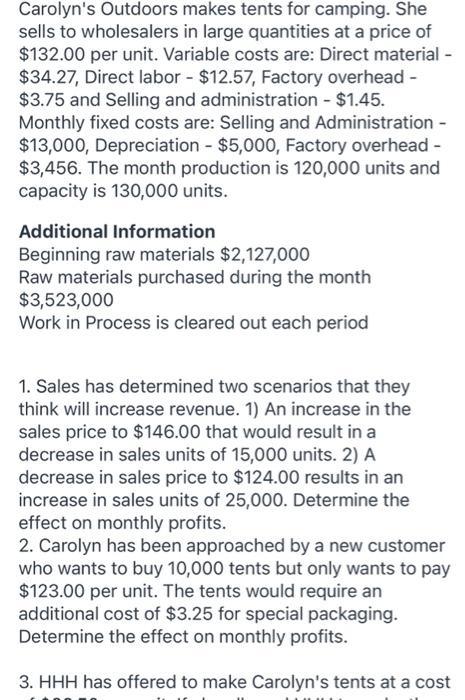

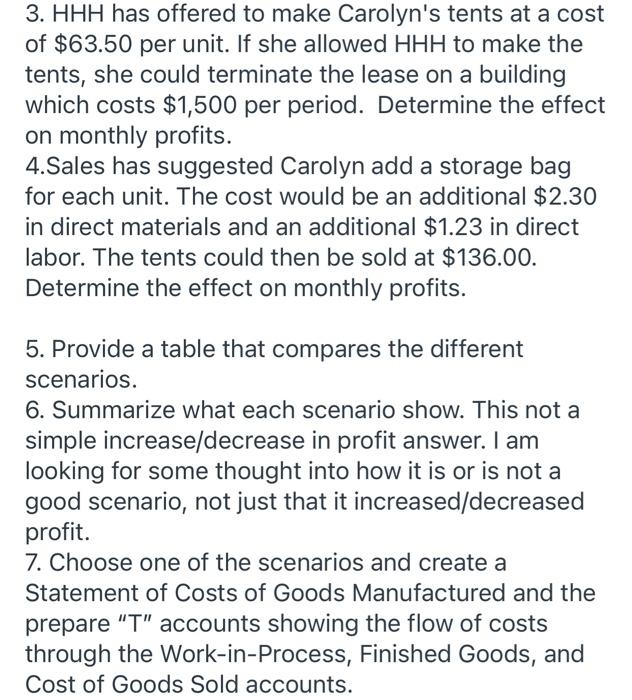

Carolyn's Outdoors makes tents for camping. She sells to wholesalers in large quantities at a price of $132.00 per unit. Variable costs are: Direct material - $34.27, Direct labor - $12.57, Factory overhead - $3.75 and Selling and administration - $1.45. Monthly fixed costs are: Selling and Administration - $13,000, Depreciation - $5,000, Factory overhead - $3,456. The month production is 120,000 units and capacity is 130,000 units. Additional Information Beginning raw materials $2,127,000 Raw materials purchased during the month $3,523,000 Work in Process is cleared out each period 1. Sales has determined two scenarios that they think will increase revenue. 1) An increase in the sales price to $146.00 that would result in a decrease in sales units of 15,000 units. 2) A decrease in sales price to $124.00 results in an increase in sales units of 25,000. Determine the effect on monthly profits. 2. Carolyn has been approached by a new customer who wants to buy 10,000 tents but only wants to pay $123.00 per unit. The tents would require an additional cost of $3.25 for special packaging. Determine the effect on monthly profits. 3. HHH has offered to make Carolyn's tents at a cost 3. HHH has offered to make Carolyn's tents at a cost of $63.50 per unit. If she allowed HHH to make the tents, she could terminate the lease on a building which costs $1,500 per period. Determine the effect on monthly profits. 4.Sales has suggested Carolyn add a storage bag for each unit. The cost would be an additional $2.30 in direct materials and an additional $1.23 in direct labor. The tents could then be sold at $136.00. Determine the effect on monthly profits. 5. Provide a table that compares the different scenarios. 6. Summarize what each scenario show. This not a simple increase/decrease in profit answer. I am looking for some thought into how it is or is not a good scenario, not just that it increased/decreased profit. 7. Choose one of the scenarios and create a Statement of Costs of Goods Manufactured and the prepare "T" accounts showing the flow of costs through the Work-in-Process, Finished Goods, and Cost of Goods Sold accounts. Carolyn's Outdoors makes tents for camping. She sells to wholesalers in large quantities at a price of $132.00 per unit. Variable costs are: Direct material - $34.27, Direct labor - $12.57, Factory overhead - $3.75 and Selling and administration - $1.45. Monthly fixed costs are: Selling and Administration - $13,000, Depreciation - $5,000, Factory overhead - $3,456. The month production is 120,000 units and capacity is 130,000 units. Additional Information Beginning raw materials $2,127,000 Raw materials purchased during the month $3,523,000 Work in Process is cleared out each period 1. Sales has determined two scenarios that they think will increase revenue. 1) An increase in the sales price to $146.00 that would result in a decrease in sales units of 15,000 units. 2) A decrease in sales price to $124.00 results in an increase in sales units of 25,000. Determine the effect on monthly profits. 2. Carolyn has been approached by a new customer who wants to buy 10,000 tents but only wants to pay $123.00 per unit. The tents would require an additional cost of $3.25 for special packaging. Determine the effect on monthly profits. 3. HHH has offered to make Carolyn's tents at a cost 3. HHH has offered to make Carolyn's tents at a cost of $63.50 per unit. If she allowed HHH to make the tents, she could terminate the lease on a building which costs $1,500 per period. Determine the effect on monthly profits. 4.Sales has suggested Carolyn add a storage bag for each unit. The cost would be an additional $2.30 in direct materials and an additional $1.23 in direct labor. The tents could then be sold at $136.00. Determine the effect on monthly profits. 5. Provide a table that compares the different scenarios. 6. Summarize what each scenario show. This not a simple increase/decrease in profit answer. I am looking for some thought into how it is or is not a good scenario, not just that it increased/decreased profit. 7. Choose one of the scenarios and create a Statement of Costs of Goods Manufactured and the prepare "T" accounts showing the flow of costs through the Work-in-Process, Finished Goods, and Cost of Goods Sold accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts