Question: Answer in excel format You have been hired by Nike Inc (NKE) to assess the viability of a new line athleisure wear. The expected sales

Answer in excel format

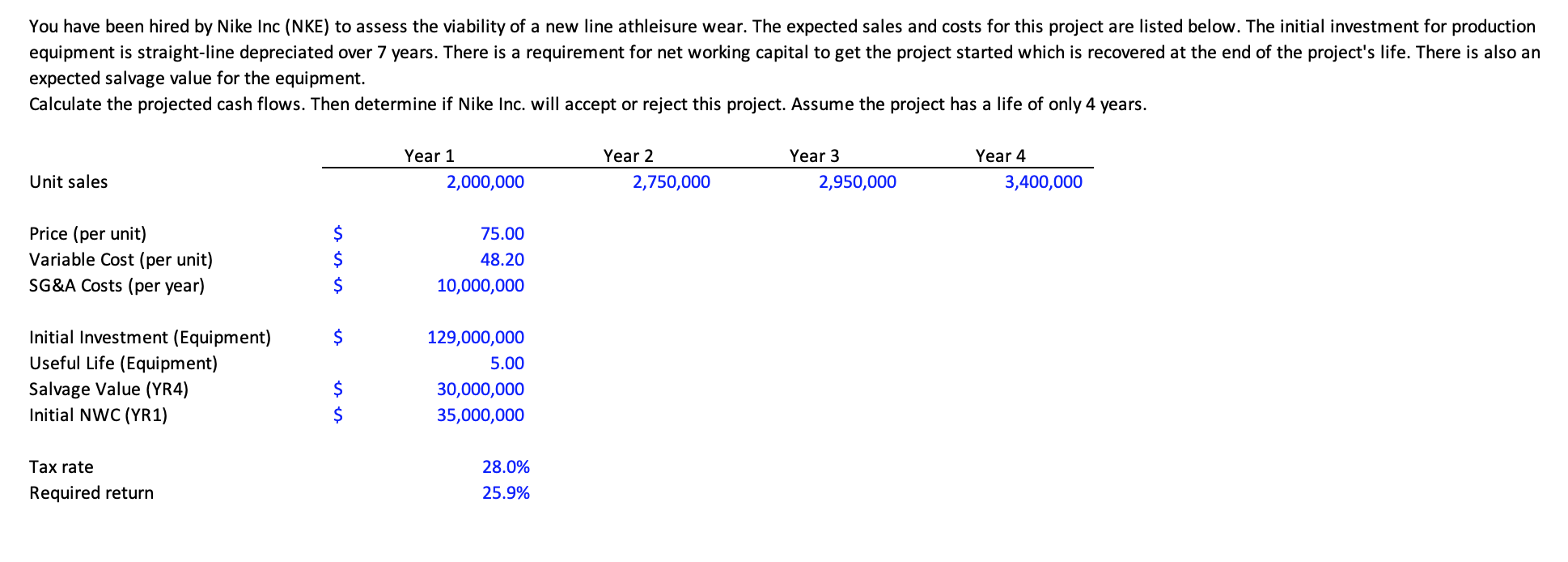

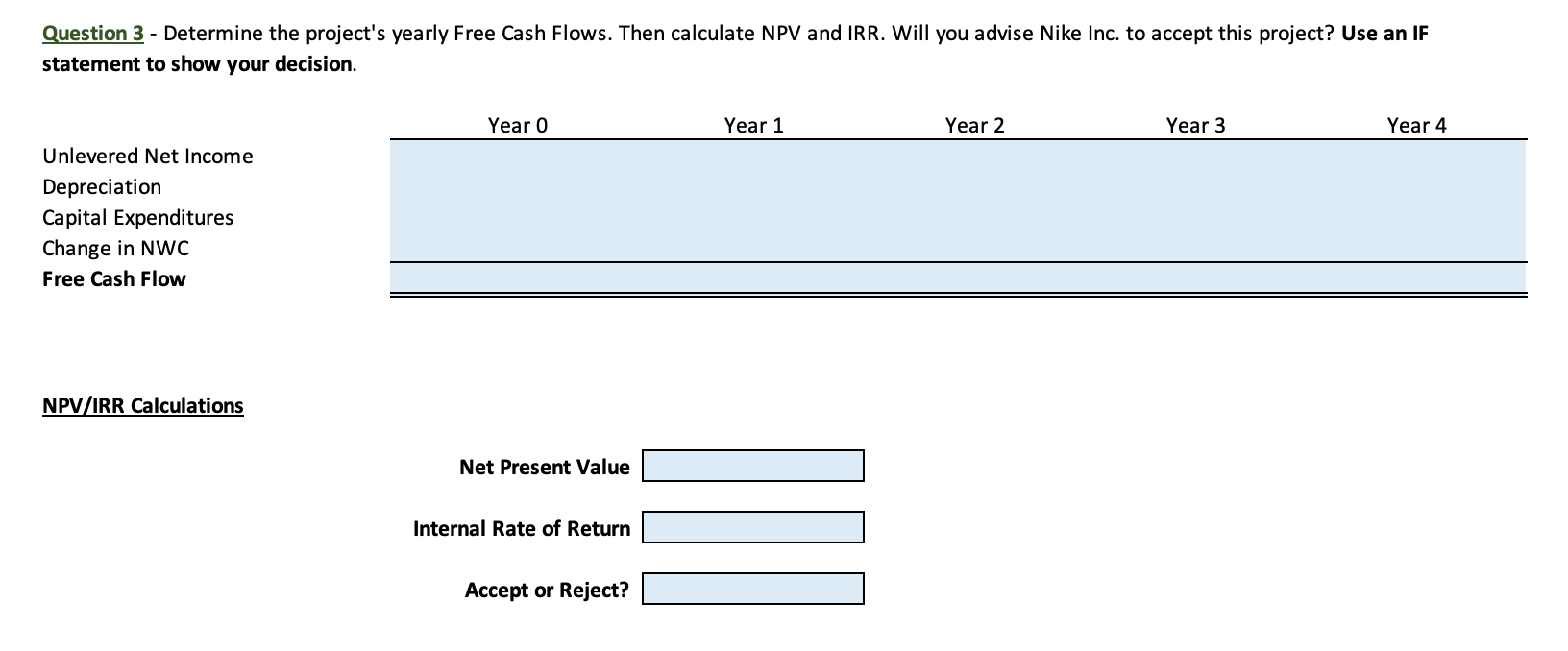

You have been hired by Nike Inc (NKE) to assess the viability of a new line athleisure wear. The expected sales and costs for this project are listed below. The initial investment for production equipment is straight-line depreciated over 7 years. There is a requirement for net working capital to get the project started which is recovered at the end of the project's life. There is also an expected salvage value for the equipment. Calculate the projected cash flows. Then determine if Nike Inc. will accept or reject this project. Assume the project has a life of only 4 years. Question 3 - Determine the project's yearly Free Cash Flows. Then calculate NPV and IRR. Will you advise Nike Inc. to accept this project? Use an IF statement to show your decision. Unlevered Net Income Depreciation Capital Expenditures Change in NWC Free Cash Flow NPV/IRR Calculations Net Present Value Internal Rate of Return Accept or Reject

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts