Question: Answer in excel please! The Cold Experience, Inc. a leading manufacturer of The frozen dessert products, is considering the addition of a new product: frozen

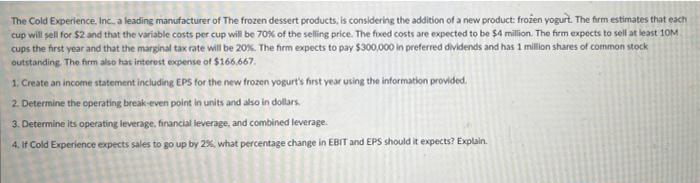

The Cold Experience, Inc. a leading manufacturer of The frozen dessert products, is considering the addition of a new product: frozen yogurt. The firm estimates that each cup will sell for $2 and that the variable costs per cup will be 70% of the selling price. The fixed costs are expected to be $1 million The firm expects to sell at least 10M cups the first year and that the marginal tax rate will be 20%. The firm expects to pay $300,000 in preferred dividends and has 1 million shares of common stock outstanding. The firm also has interest expense of $166,667 1. Create an income statement including EPS for the new frozen yogurt's first year using the information provided 2. Determine the operating break-even point in units and also in dollars 3. Determine its operating leverage, financial leverage, and combined leverage 4. If Cold Experience expects sales to go up by 2%, what percentage change in EBIT and Eps should it expects? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts