Question: answer in excel with formulas please Obtain financial statements - income statements and balance sheets - for Fedex Corp (ticker: FDX) for the most recent

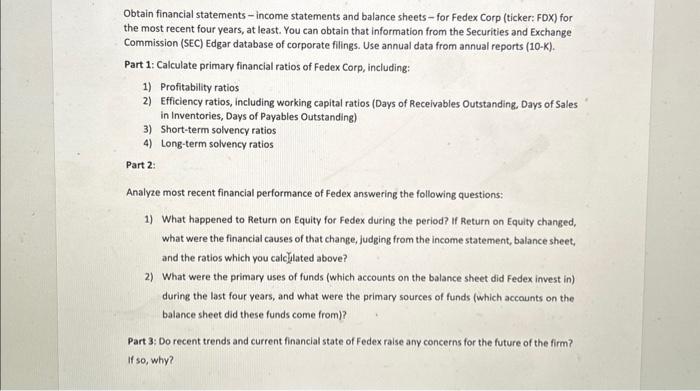

Obtain financial statements - income statements and balance sheets - for Fedex Corp (ticker: FDX) for the most recent four years, at least. You can obtain that information from the Securities and Exchange Commission (SEC) Edgar database of corporate filings. Use annual data from annual reports (10-K). Part 1: Calculate primary financial ratios of Fedex Corp, including: 1) Profitability ratios 2) Efficiency ratios, including working capital ratios (Days of Receivables Outstanding, Days of Sales in Inventories, Days of Payables Outstanding) 3) Short-term solvency ratios 4) Long-term solvency ratios Part 2: Analyze most recent financial performance of Fedex answering the following questions: 1) What happened to Return on Equity for Fedex during the period? If Return on Equity changed, what were the financial causes of that change, judging from the income statement, balance sheet, and the ratios which you calclilated above? 2) What were the primary uses of funds (which accounts on the balance sheet did Fedex invest in) during the last four years, and what were the primary sources of funds (which accounts on the balance sheet did these funds come from)? Part 3: Do recent trends and current financial state of Fedex raise any concerns for the future of the firm? If so, why? Obtain financial statements - income statements and balance sheets - for Fedex Corp (ticker: FDX) for the most recent four years, at least. You can obtain that information from the Securities and Exchange Commission (SEC) Edgar database of corporate filings. Use annual data from annual reports (10-K). Part 1: Calculate primary financial ratios of Fedex Corp, including: 1) Profitability ratios 2) Efficiency ratios, including working capital ratios (Days of Receivables Outstanding, Days of Sales in Inventories, Days of Payables Outstanding) 3) Short-term solvency ratios 4) Long-term solvency ratios Part 2: Analyze most recent financial performance of Fedex answering the following questions: 1) What happened to Return on Equity for Fedex during the period? If Return on Equity changed, what were the financial causes of that change, judging from the income statement, balance sheet, and the ratios which you calclilated above? 2) What were the primary uses of funds (which accounts on the balance sheet did Fedex invest in) during the last four years, and what were the primary sources of funds (which accounts on the balance sheet did these funds come from)? Part 3: Do recent trends and current financial state of Fedex raise any concerns for the future of the firm? If so, why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts