Question: answer in excel, write clearly, all steps please. Problem 3: In Jun 2009, you want to buy the US Treasury issued 10.00% bonds maturing at

answer in excel, write clearly, all steps please.

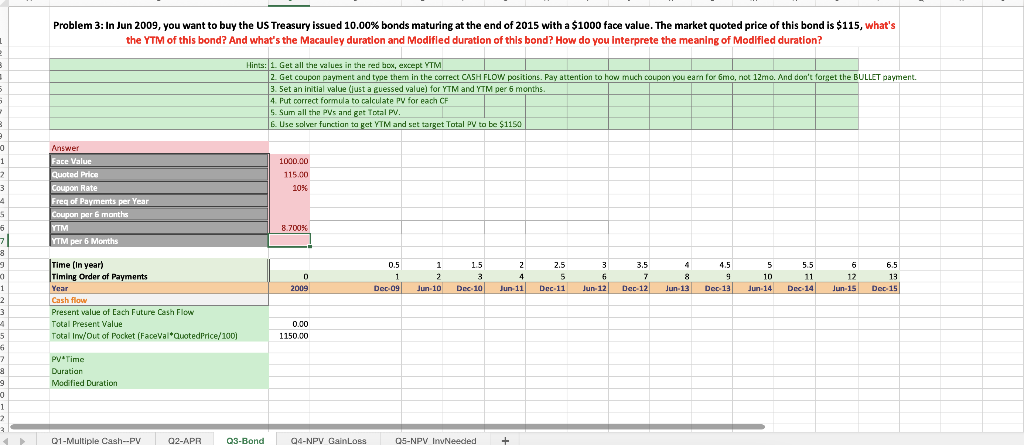

Problem 3: In Jun 2009, you want to buy the US Treasury issued 10.00\% bonds maturing at the end of 2015 with a $1000 face value. The market quoted price of this bond is $115, what's the YTM of this bond? And what's the Macauley duration and Modifled duration of this bond? How do you Interprete the meaning of Modifled duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts