Question: answer in format provided PR 25-2A Cash payback period, net present value method, and analysis Obj. 2,3 Elite Apparel Inc. is considering two investment projects.

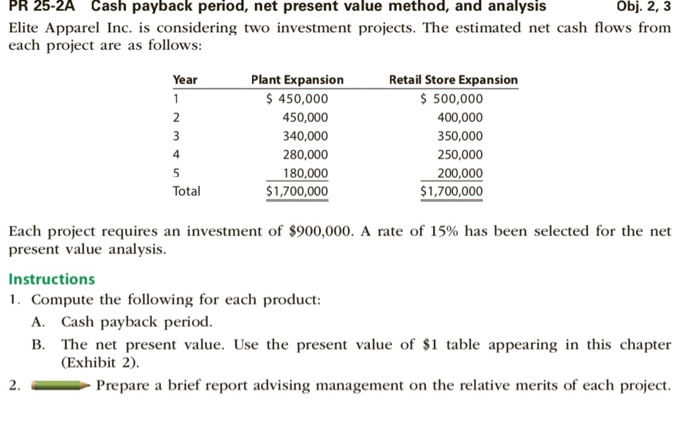

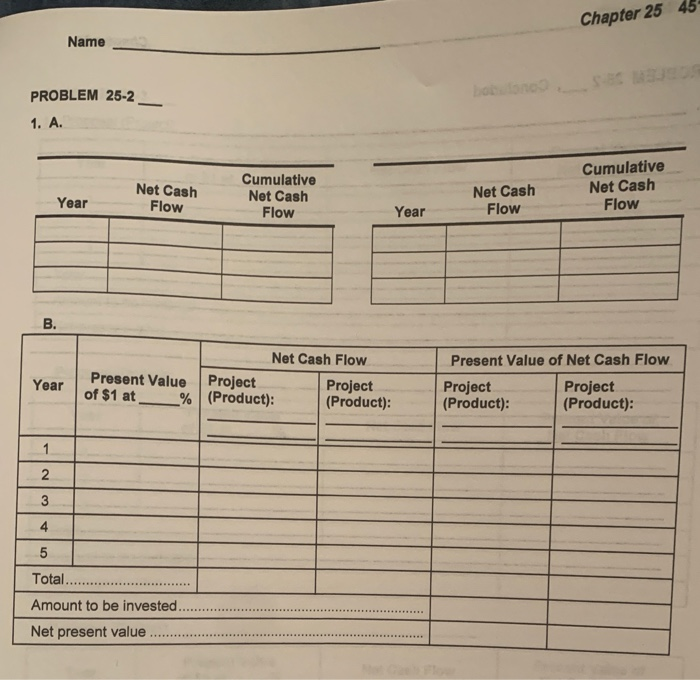

PR 25-2A Cash payback period, net present value method, and analysis Obj. 2,3 Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Plant Expansion $ 450,000 450,000 340,000 280,000 180,000 $1,700,000 Retail Store Expansion $ 500,000 400,000 350,000 250,000 200,000 $1,700,000 Total Each project requires an investment of $900,000. A rate of 15% has been selected for the net present value analysis. Instructions 1. Compute the following for each product: A. Cash payback period. B. The net present value. Use the present value of $1 table appearing in this chapter (Exhibit 2). Prepare a brief report advising management on the relative merits of each project. Chapter 25 45 Name PROBLEM 25-2 1. A. Net Cash Flow Year Cumulative Net Cash Flow Cumulative Net Cash Flow Net Cash Flow Year Year Present Value of $1 at % Net Cash Flow Project Project (Product): (Product): Present Value of Net Cash Flow Project Project (Product): (Product): GWN- 5 Total............................... Amount to be invested...................................................... Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts