Question: answer in table form and all parta please During 2022, Andrea sustains serious injuries from a snow-skiing accident. She incurs the following expenses: View expenses

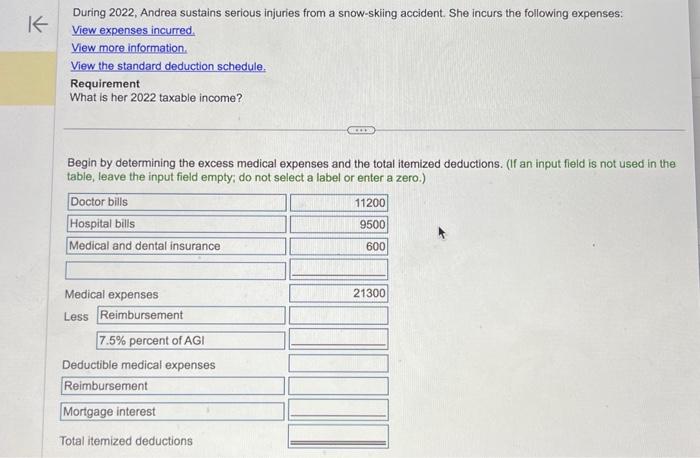

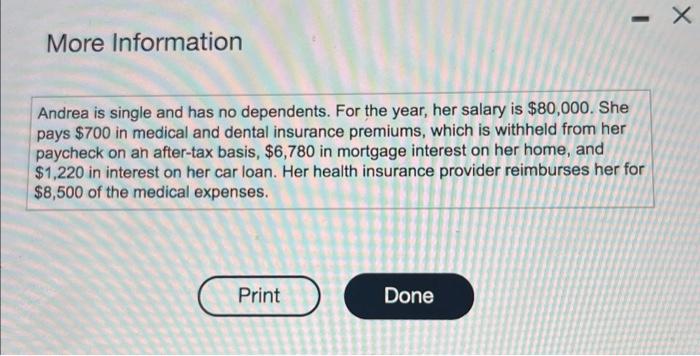

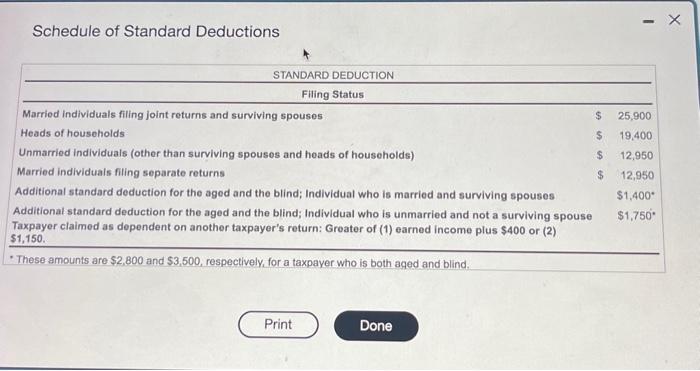

During 2022, Andrea sustains serious injuries from a snow-skiing accident. She incurs the following expenses: View expenses incurred. View more information. View the standard deduction schedule. Requirement What is her 2022 taxable income? Begin by determining the excess medical expenses and the total itemized deductions. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) More Information Andrea is single and has no dependents. For the year, her salary is $80,000. She pays $700 in medical and dental insurance premiums, which is withheld from her paycheck on an after-tax basis, $6,780 in mortgage interest on her home, and $1,220 in interest on her car loan. Her health insurance provider reimburses her for $8,500 of the medical expenses. Schedule of Standard Deductions Adjusted gross income (AGI) $65,000 Minus: Deductions from AGI: Itemized deductions (15,275) Taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts