Question: answer in yes or no Holcomb Inc. was a privately owned company until last year, when it went public. Holcomb wants to ensure that it

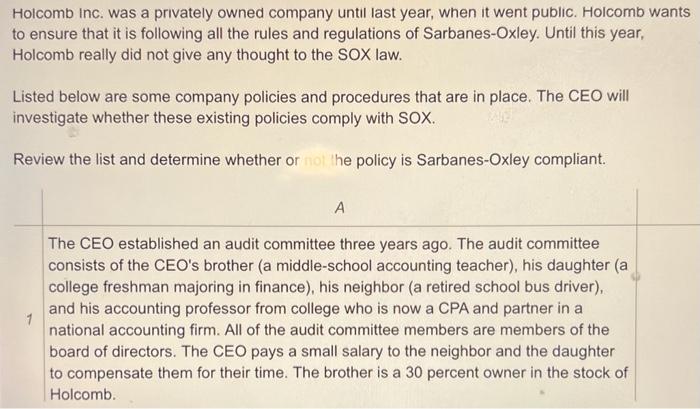

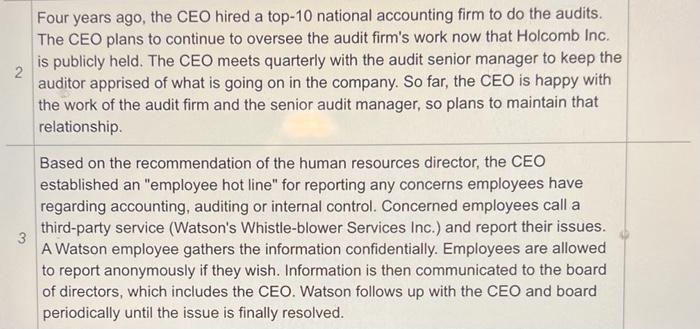

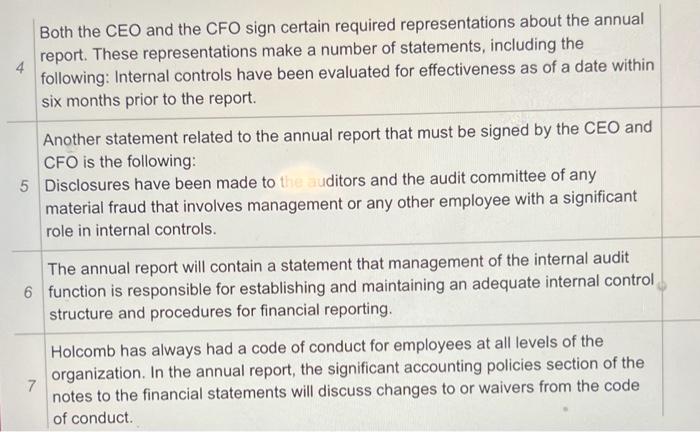

Holcomb Inc. was a privately owned company until last year, when it went public. Holcomb wants to ensure that it is following all the rules and regulations of Sarbanes-Oxley. Until this year, Holcomb really did not give any thought to the SOX law. Listed below are some company policies and procedures that are in place. The CEO will investigate whether these existing policies comply with SOX. Review the list and determine whether or he policy is Sarbanes-Oxley compliant. 4 The CEO established an audit committee three years ago. The audit committee consists of the CEO's brother (a middle-school accounting teacher), his daughter (a college freshman majoring in finance), his neighbor (a retired school bus driver), and his accounting professor from college who is now a CPA and partner in a national accounting firm. All of the audit committee members are members of the board of directors. The CEO pays a small salary to the neighbor and the daughter to compensate them for their time. The brother is a 30 percent owner in the stock of Holcomb. Four years ago, the CEO hired a top-10 national accounting firm to do the audits. The CEO plans to continue to oversee the audit firm's work now that Holcomb Inc. is publicly held. The CEO meets quarterly with the audit senior manager to keep the auditor apprised of what is going on in the company. So far, the CEO is happy with the work of the audit firm and the senior audit manager, so plans to maintain that relationship. Based on the recommendation of the human resources director, the CEO established an "employee hot line" for reporting any concerns employees have regarding accounting, auditing or internal control. Concerned employees call a third-party service (Watson's Whistle-blower Services Inc.) and report their issues. A Watson employee gathers the information confidentially. Employees are allowed to report anonymously if they wish. Information is then communicated to the board of directors, which includes the CEO. Watson follows up with the CEO and board periodically until the issue is finally resolved. Both the CEO and the CFO sign certain required representations about the annual report. These representations make a number of statements, including the following: Internal controls have been evaluated for effectiveness as of a date within six months prior to the report. Another statement related to the annual report that must be signed by the CEO and CFO is the following: 5 Disclosures have been made to thitors and the audit committee of any material fraud that involves management or any other employee with a significant role in internal controls. The annual report will contain a statement that management of the internal audit 6 function is responsible for establishing and maintaining an adequate internal control structure and procedures for financial reporting. Holcomb has always had a code of conduct for employees at all levels of the organization. In the annual report, the significant accounting policies section of the notes to the financial statements will discuss changes to or waivers from the code of conduct. Holcomb's audit firm has maintained workpapers for the audits for the past nine years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts