Question: Answer INCORRECT boxes for thumbs up Crane Truff designs and manufactures a variety of personal products including wallets, purses, and key chains. Crane is proposing

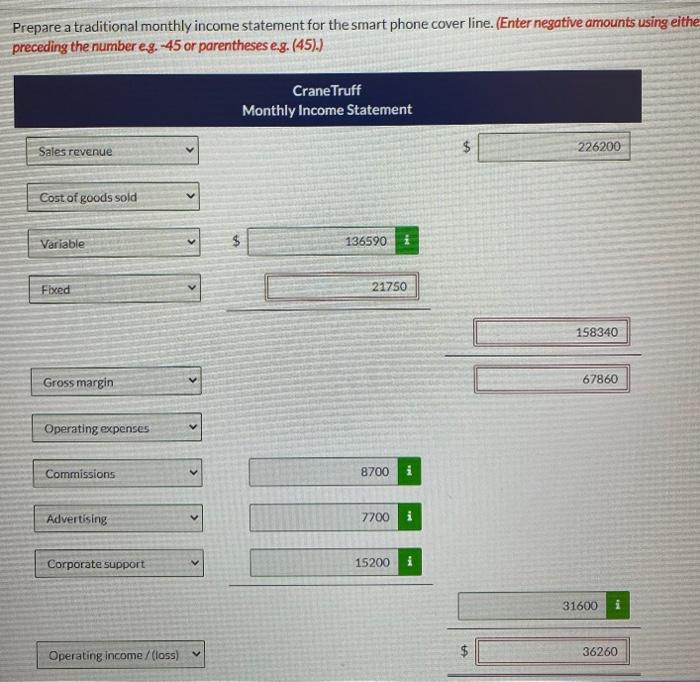

Crane Truff designs and manufactures a variety of personal products including wallets, purses, and key chains. Crane is proposing to begin manufacturing smart phone covers which sell for $26 each. Crane estimates that monthly sales volume will be 8,700 units. Variable product costs will be $15.70 per unit and fixed overhead will be $5 per unit. Half of the fixed overhead is directly traceable to the smart phone cover line. To promote the covers, Crane proposes a $1 per unit commission to the company's salespeople and a $7,700 per month advertising campaign. In compliance with corporate policy, the smart phone cover line will also be allocated $15,200 in fixed corporate support costs. Prepare a traditional monthly income statement for the smart phone cover line. (Enter negative amounts using eithe preceding the number e.g. -45 or parentheses e.g. (45).) Crane Truff Monthly Income Statement Sales revenue 226200 Cost of goods sold Variable 136590 i Fixed 21750 158340 Gross margin 67860 Operating expenses Commissions Advertising Corporate support 31600 i Operating income/(loss) 36260 SA 8700 7700 15200 54

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts