Question: Answer is -$68,165.28. Here is my work with the incorrect answer: 10. Toscano Enterprises is evaluating a 7-year project with an initial fixed asset investment

Answer is -$68,165.28.

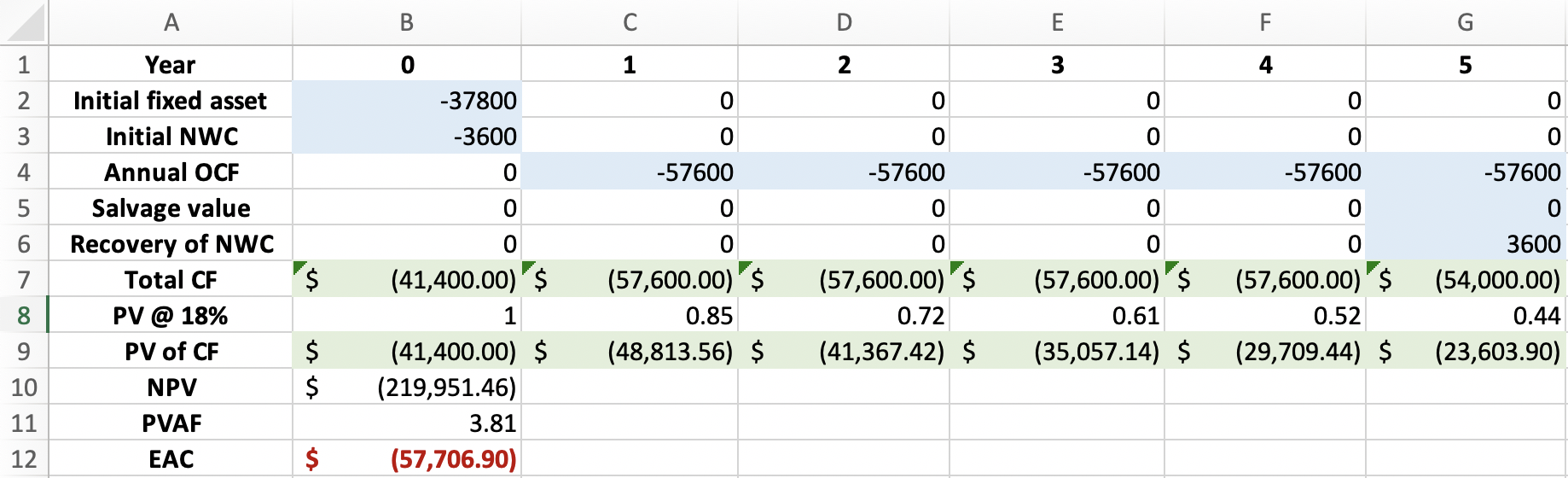

Here is my work with the incorrect answer:

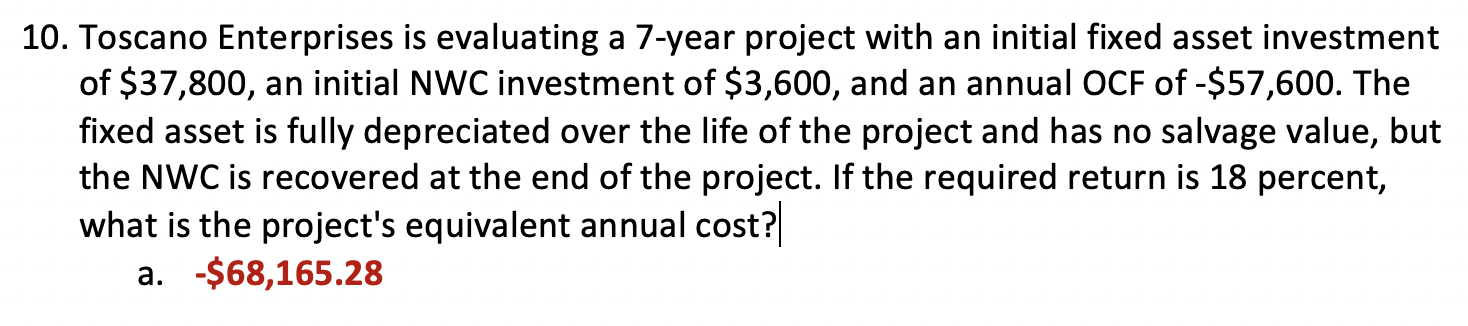

10. Toscano Enterprises is evaluating a 7-year project with an initial fixed asset investment of $37,800, an initial NWC investment of $3,600, and an annual OCF of -$57,600. The fixed asset is fully depreciated over the life of the project and has no salvage value, but the NWC is recovered at the end of the project. If the required return is 18 percent, what is the project's equivalent annual cost? a. $68,165.28 A B C D E G 1 0 1 2 3 5 2. 0 0 0 0 0 -37800 -3600 w 0 0 0 0 0 3 4 5 4 0 -57600 -57600 -57600 -57600 -57600 0 0 0 0 0 0 6 0 0 0 Year Initial fixed asset Initial NWC Annual OCF Salvage value Recovery of NWC Total CF PV @ 18% PV of CF NPV PVAF EAC 7 $ (57,600.00) $ 0.85 (48,813.56) $ 0 (57,600.00) $ 0.72 (41,367.42) $ 8 (57,600.00) $ 0.61 (35,057.14) $ 3600 (54,000.00) 0.44 (23,603.90) (57,600.00) $ 0.52 (29,709.44) $ 9 $ $ (41,400.00) $ 1 (41,400.00) $ (219,951.46) 3.81 (57,706.90) 10 11 12 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts