Question: answer is A but i need help with knowing how to get to that answer Assume an investor acquires a retail property for $2,300,000 (including

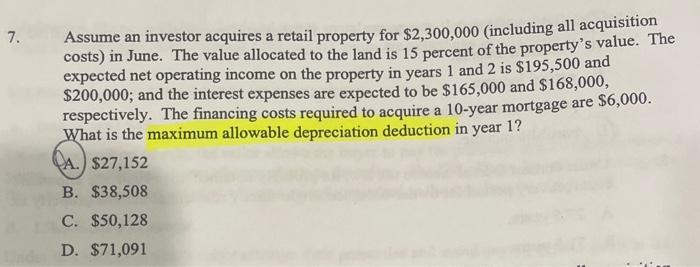

Assume an investor acquires a retail property for $2,300,000 (including all acquisition costs) in June. The value allocated to the land is 15 percent of the property's value. The expected net operating income on the property in years 1 and 2 is $195,500 and $200,000; and the interest expenses are expected to be $165,000 and $168,000, respectively. The financing costs required to acquire a 10 -year mortgage are $6,000. What is the maximum allowable depreciation deduction in year 1 ? A. $27,152 B. $38,508 C. $50,128 D. $71,091

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts