Question: answer is a i need solution Two companies have access to the following deposit offers in the market: Company A - 6 at a fixed

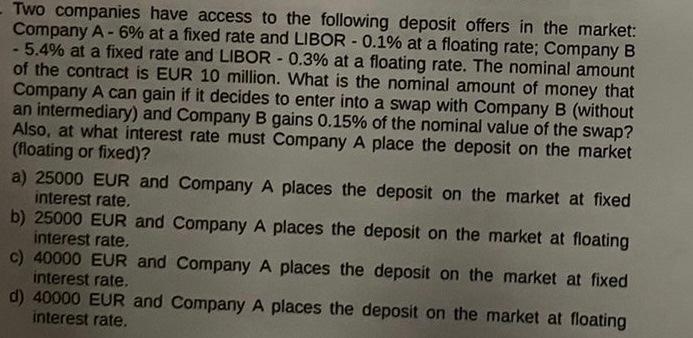

Two companies have access to the following deposit offers in the market: Company A - \6 at a fixed rate and LIBOR - \0.1 at a floating rate; Company \\( B \\) \5.4 at a fixed rate and LIBOR \0.3 at a floating rate. The nominal amount of the contract is EUR 10 million. What is the nominal amount of money that Company \\( A \\) can gain if it decides to enter into a swap with Company B (without an intermediary) and Company \\( B \\) gains \0.15 of the nominal value of the swap? Also, at what interest rate must Company A place the deposit on the market (floating or fixed)? a) 25000 EUR and Company A places the deposit on the market at fixed interest rate. b) 25000 EUR and Company A places the deposit on the market at floating interest rate. c) 40000 EUR and Company A places the deposit on the market at fixed interest rate. d) 40000 EUR and Company A places the deposit on the market at floating interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts