Question: Answer is A, please show all steps and calculations so I can fully understand how to solve. thank you ! 6. Miller Brothers has determined

Answer is A, please show all steps and calculations so I can fully understand how to solve. thank you !

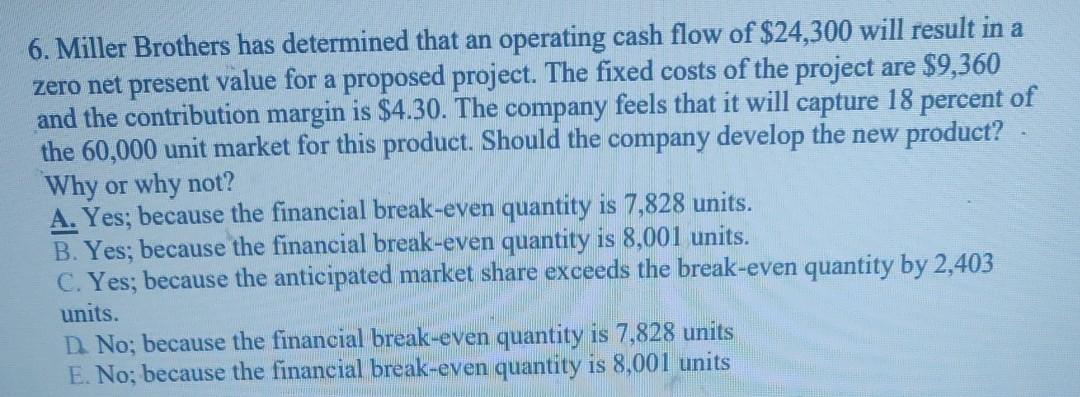

6. Miller Brothers has determined that an operating cash flow of $24,300 will result in a zero net present value for a proposed project. The fixed costs of the project are $9,360 and the contribution margin is $4.30. The company feels that it will capture 18 percent of the 60,000 unit market for this product. Should the company develop the new product? Why or why not? A. Yes; because the financial break-even quantity is 7,828 units. B. Yes, because the financial break-even quantity is 8,001 units. C. Yes; because the anticipated market share exceeds the break-even quantity by 2,403 units. n No; because the financial break-even quantity is 7,828 units E. No; because the financial break-even quantity is 8,001 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts