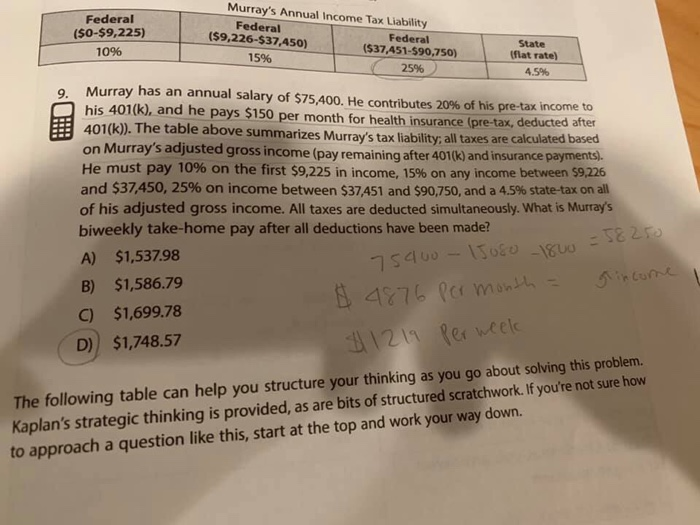

Question: answer is D. please explain it Murray's Annual Income Tax Liability Federal ($9,226-$37,450) Federal (537,451-590,750) o o Federal ($0-$9,225) State 10% 15% Iflat rate) 25%

Murray's Annual Income Tax Liability Federal ($9,226-$37,450) Federal (537,451-590,750) o o Federal ($0-$9,225) State 10% 15% Iflat rate) 25% 4.5% Murray has an annual salary of $75,400. He contributes 20% of his pre-tax income to his 401(k), and he pays $150 per month for health insurance (pre-tax, deducted after 401(k)). The table above summarizes Murray's tax liability, all taxes are calculated based on Murray's adjusted gross income (pay remaining after 401(k) and insurance payments). He must pay 10% on the first $9,225 in income, 15% on any income between 9,226 and $37,450, 25% on income between $37,451 and $90,750, and a 4.5% state-tax on all of his adjusted gross income. All taxes are deducted simultaneously. What is Murray's biweekly take-home pay after all deductions have been made? A) $1,537.98 B) $1,586.79 C) $1,699.78 D) $1,748.57 75400 - 5080 -1800 - $ 4876 per month income 41219 per week The following table can help you structure your thinking as you go about solving this problem. Kaplan's strategic thinking is provided, as are bits of structured scratchwork. If you're not sure how to approach a question like this, start at the top and work your way down

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts