Question: Answer is D, please show and explain how to get it! 23. Rock Solid has a stock portfolio worth $100 million, which tracks closely with

Answer is D, please show and explain how to get it!

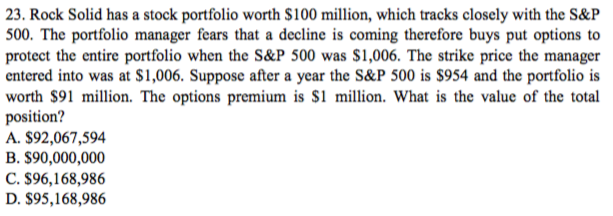

23. Rock Solid has a stock portfolio worth $100 million, which tracks closely with the S&P 500. The portfolio manager fears that a decline is coming therefore buys put options to protect the entire portfolio when the S&P 500 was $1,006. The strike price the manager entered into was at $1,006. Suppose after a year the S&P 500 is S954 and the portfolio is worth S91 million. The options premium is S1 mlon. What is the value of the total position? A. $92,067,594 B. S90,000,000 C. $96,168,986 D. S95,168,986

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts