Question: answer is E but please explain why 10. The example illustrates the concept about price risk and reinvestment risk. Assume you purchase a four-year annual

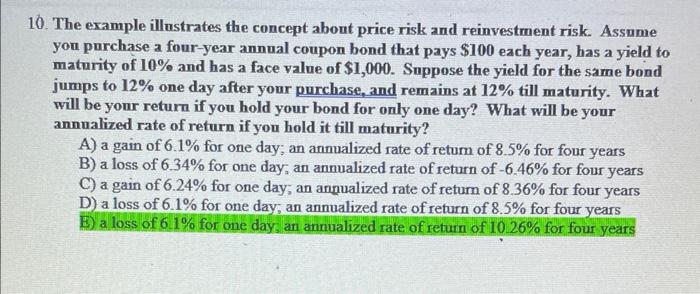

10. The example illustrates the concept about price risk and reinvestment risk. Assume you purchase a four-year annual coupon bond that pays $100 each year, has a yield to maturity of 10% and has a face value of $1,000. Snppose the yield for the same bond jumps to 12% one day after your purchase, and remains at 12% till maturity. What will be your return if you hold your bond for only one day? What will be your annualized rate of return if you hold it till maturity? A) a gain of 6.1% for one day; an anmualized rate of return of 8.5% for four years B) a loss of 6.34% for one day; an annualized rate of return of 6.46% for four years C) a gain of 6.24% for one day; an annualized rate of return of 8.36% for four years D) a loss of 6.1% for one day; an annualized rate of return of 8.5% for four years E) a loss of 6.1% for one day; an annualized rate of return of 10.26% for four years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts