Question: Answer is E, can anyone show the steps? Frankenstein Electric has a capital structure that consists of 60 percent equity and 40 percent debt. The

Answer is E, can anyone show the steps?

Answer is E, can anyone show the steps?

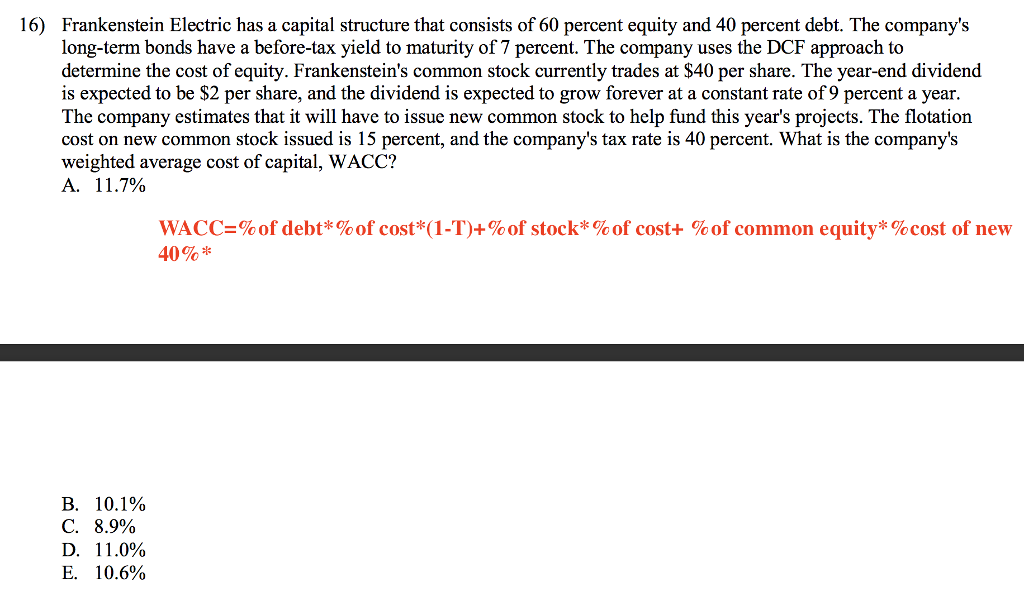

Frankenstein Electric has a capital structure that consists of 60 percent equity and 40 percent debt. The company's long-term bonds have a before-tax yield to maturity of 7 percent. The company uses the DCF approach to determine the cost of equity. Frankenstein's common stock currently trades at $40 per share. The year-end dividend is expected to be $2 per share, and the dividend is expected to grow forever at a constant rate of 9 percent a year. The company estimates that it will have to issue new common stock to help fund this year's projects. The flotation cost on new common stock issued is 15 percent, and the company's tax rate is 40 percent. What is the company's weighted average cost of capital, WACC? 16) WACC-% of debt* % of cost"( 1-T)+% of stock" % of cost+ % of common equity" %cost of new 40%* B. 10.1% C. 8.9% D. 11.0% E. 10.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts