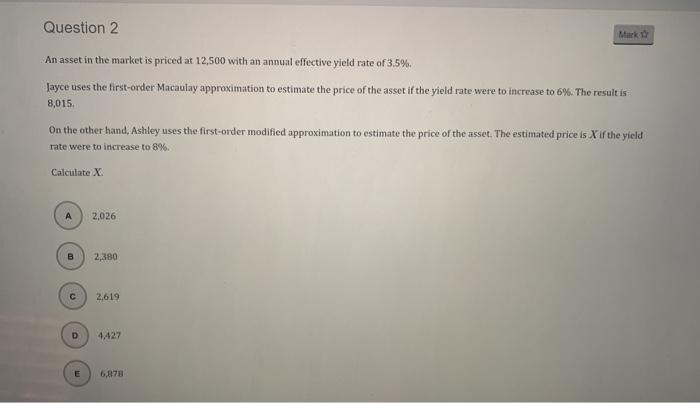

Question: answer is not 4700 Question 2 Mark An asset in the market is priced at 12,500 with an annual effective yield rate of 3,5%. Jayce

answer is not 4700

Question 2 Mark An asset in the market is priced at 12,500 with an annual effective yield rate of 3,5%. Jayce uses the first-order Macaulay approximation to estimate the price of the asset if the yield rate were to increase to 6%. The result is 8,015 On the other hand, Ashley uses the first-order modified approximation to estimate the price of the asset. The estimated price is X if the yield rate were to increase to 8%. Calculate X 2,026 B 2,380 2,619 D 4,427 6,878

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock