Question: Answer is not 8.11. Please provide answer to the division and not the individual firms. Thank you. Question 9 0/3 points A company is going

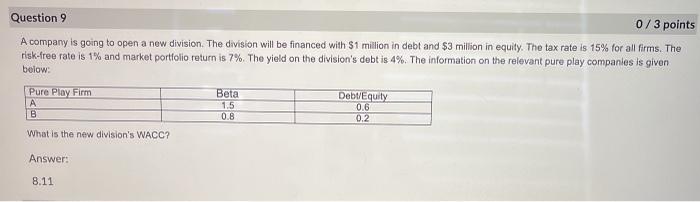

Question 9 0/3 points A company is going to open a new division. The division will be financed with $1 million in debt and $3 million in equity. The tax rate is 15% for all firms. The risk-free rate is 1% and market portfolio return is 7%. The yield on the division's debtis 4%. The information on the relevant pure play companies is given below: Pure Play Firm Beta Debt/Equity A 1.5 0.6 B 0.8 0.2 What is the new division's WACC? Answer: 8.11 Question 9 0/3 points A company is going to open a new division. The division will be financed with $1 million in debt and $3 million in equity. The tax rate is 15% for all firms. The risk-free rate is 1% and market portfolio return is 7%. The yield on the division's debtis 4%. The information on the relevant pure play companies is given below: Pure Play Firm Beta Debt/Equity A 1.5 0.6 B 0.8 0.2 What is the new division's WACC? Answer: 8.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts