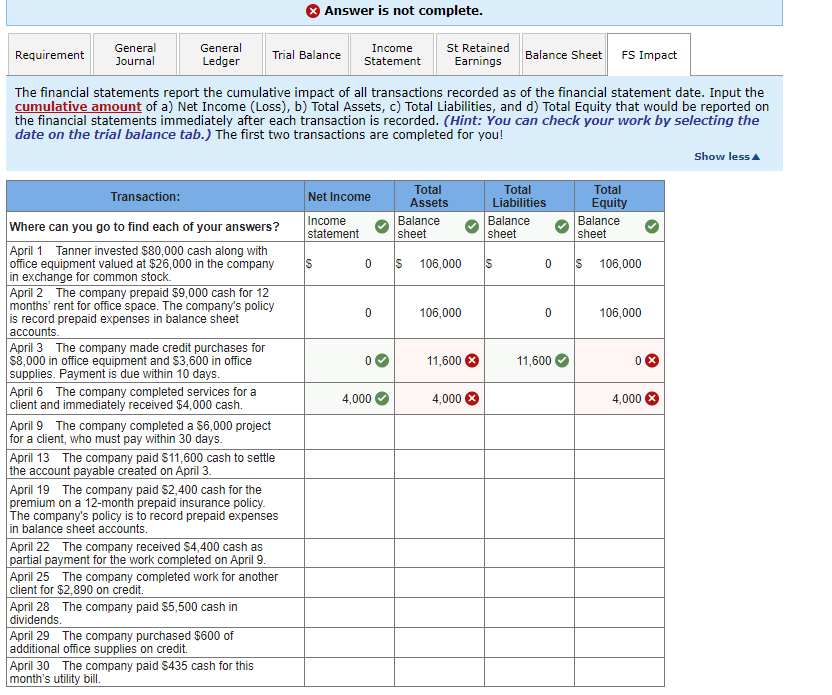

Question: Answer is not complete. General Journal Requirement General Ledger Trial Balance Income Statement St Retained Balance Sheet Earnings FS Impact The financial statements report the

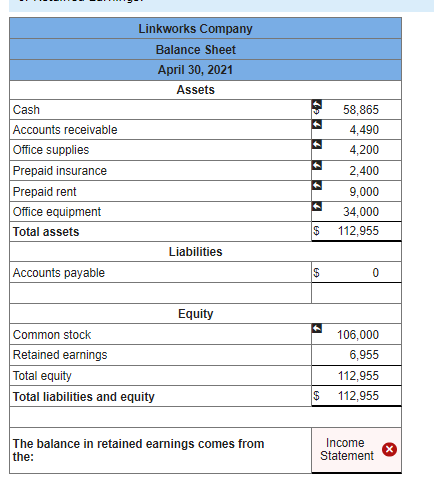

Answer is not complete. General Journal Requirement General Ledger Trial Balance Income Statement St Retained Balance Sheet Earnings FS Impact The financial statements report the cumulative impact of all transactions recorded as of the financial statement date. Input the cumulative amount of a) Net Income (Loss), b) Total Assets, c) Total Liabilities, and d) Total Equity that would be reported on the financial statements immediately after each transaction is recorded. (Hint: You can check your work by selecting the date on the trial balance tab.) The first two transactions are completed for you! Show less Transaction: Net Income Income statement Total Assets Balance sheet Total Liabilities Balance sheet Total Equity Balance sheet S 0 S 106,000 S $ 0 S 106,000 0 106,000 0 106,000 0 11,600 11,600 4,000 4,000 4,000 Where can you go to find each of your answers? April 1 Tanner invested $80,000 cash along with office equipment valued at $26,000 in the company in exchange for common stock April 2 The company prepaid $9,000 cash for 12 months' rent for office space. The company's policy is record prepaid expenses in balance sheet accounts. April 3 The company made credit purchases for $8,000 in office equipment and $3,600 in office supplies. Payment is due within 10 days. April 6 The company completed services for a client and immediately received $4,000 cash. April 9 The company completed a $6,000 project for a client, who must pay within 30 days. April 13 The company paid $11,600 cash to settle the account payable created on April 3. April 19 The company paid $2,400 cash for the premium on a 12-month prepaid insurance policy. The company's policy is to record prepaid expenses in balance sheet accounts. April 22 The company received $4,400 cash as partial payment for the work completed on April 9. April 25 The company completed work for another client for $2,890 on credit. April 28 The company paid $5,500 cash in dividends. April 29 The company purchased $600 of additional office supplies on credit. April 30 The company paid $435 cash for this month's utility bill. Linkworks Company Balance Sheet April 30, 2021 Assets Cash Accounts receivable Office supplies Prepaid insurance Prepaid rent Office equipment Total assets 58,865 4,490 4,200 2,400 9,000 34,000 112,955 $ Liabilities Accounts payable $ 0 Equity Common stock Retained earnings Total equity Total liabilities and equity 106,000 6,955 112,955 112,955 $ The balance in retained earnings comes from the: Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts