Question: Answer is provided, please show all steps and all calculations so I can fully understand how to solve. thank you 7. The managers of PonchoParts,

Answer is provided, please show all steps and all calculations so I can fully understand how to solve. thank you

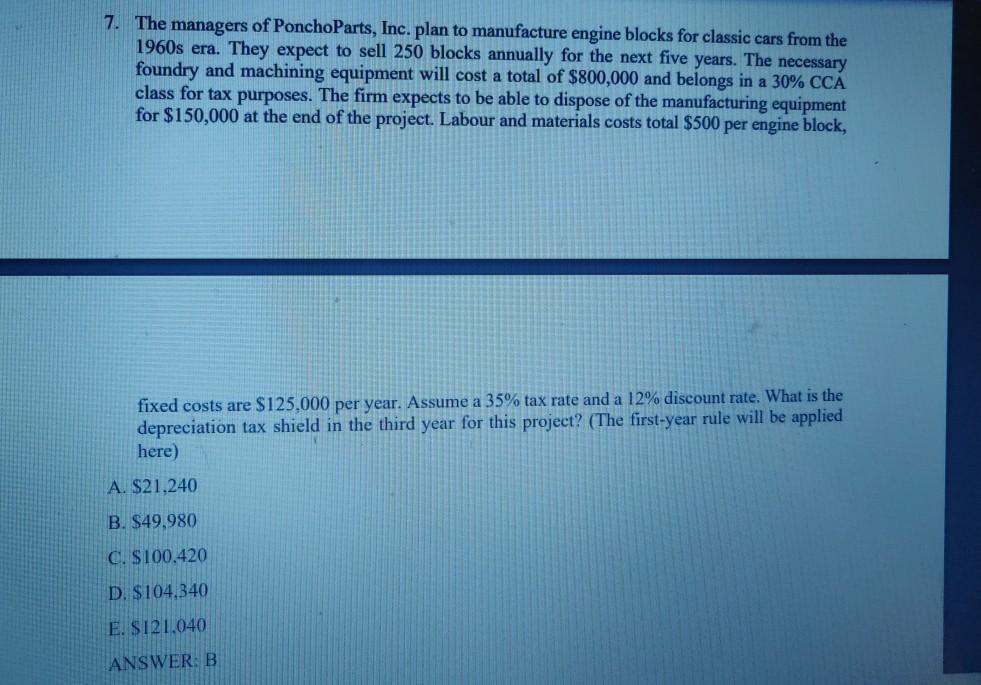

7. The managers of PonchoParts, Inc. plan to manufacture engine blocks for classic cars from the 1960s era. They expect to sell 250 blocks annually for the next five years. The necessary foundry and machining equipment will cost a total of $800,000 and belongs in a 30% CCA class for tax purposes. The firm expects be able to dispose of the manufacturing equipment for $150,000 at the end of the project. Labour and materials costs total $500 per engine block, fixed costs are $125,000 per year. Assume a 35% tax rate and a 12% discount rate. What is the depreciation tax shield in the third year for this project? (The first-year rule will be applied here) A. $21,240 B. $49.980 C. S100,420 D. $ 104,340 E. SI21,040 ANSWER: B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts