Question: Answer is wrong, please explain how to get the answer. A taxpayer sold the following items in the current year: - A block of land

Answer is wrong, please explain how to get the answer.

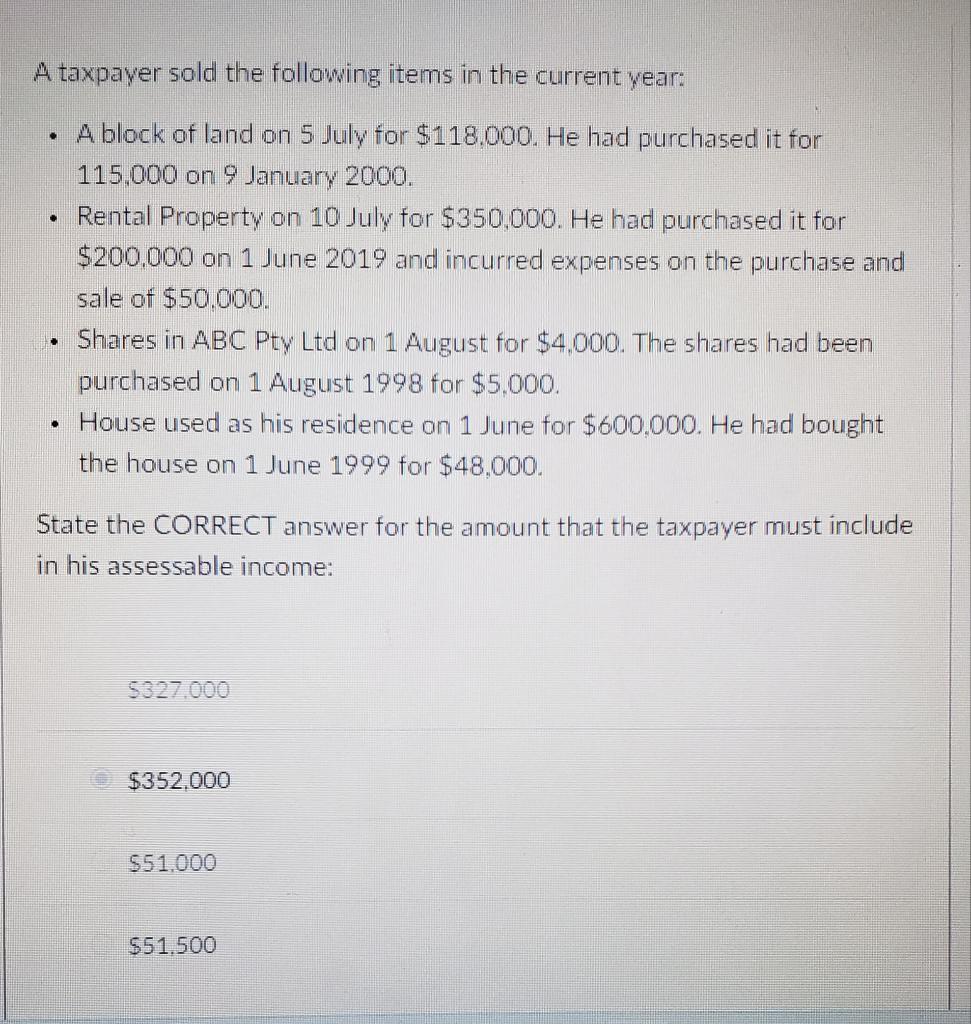

A taxpayer sold the following items in the current year: - A block of land on 5 July for $118,000. He had purchased it for 115,000 on 9 January 2000. - Rental Property on 10 July for \$350,000. He had purchased it for $200,000 on 1 June 2019 and incurred expenses on the purchase and sale of $50.000. - Shares in ABC Pty Ltd on 1 August for $4,000. The shares had been purchased on 1 August 1998 for $5,000. - House used as his residence on 1 June for $600,000. He had bought the house on 1 June 1999 for $48,000. State the CORRECT answer for the amount that the taxpayer must include in his assessable income: 5327,000 $352,000 $51,000 $51,500

Step by Step Solution

There are 3 Steps involved in it

Lets analyze each asset and calculate the capital gains assuming Australian CGT rules which seem to ... View full answer

Get step-by-step solutions from verified subject matter experts