Question: Answer is wrong please ignore it, please explain how to get the right answer. Gareth owns a rental house which he bought on 25 September

Answer is wrong please ignore it, please explain how to get the right answer.

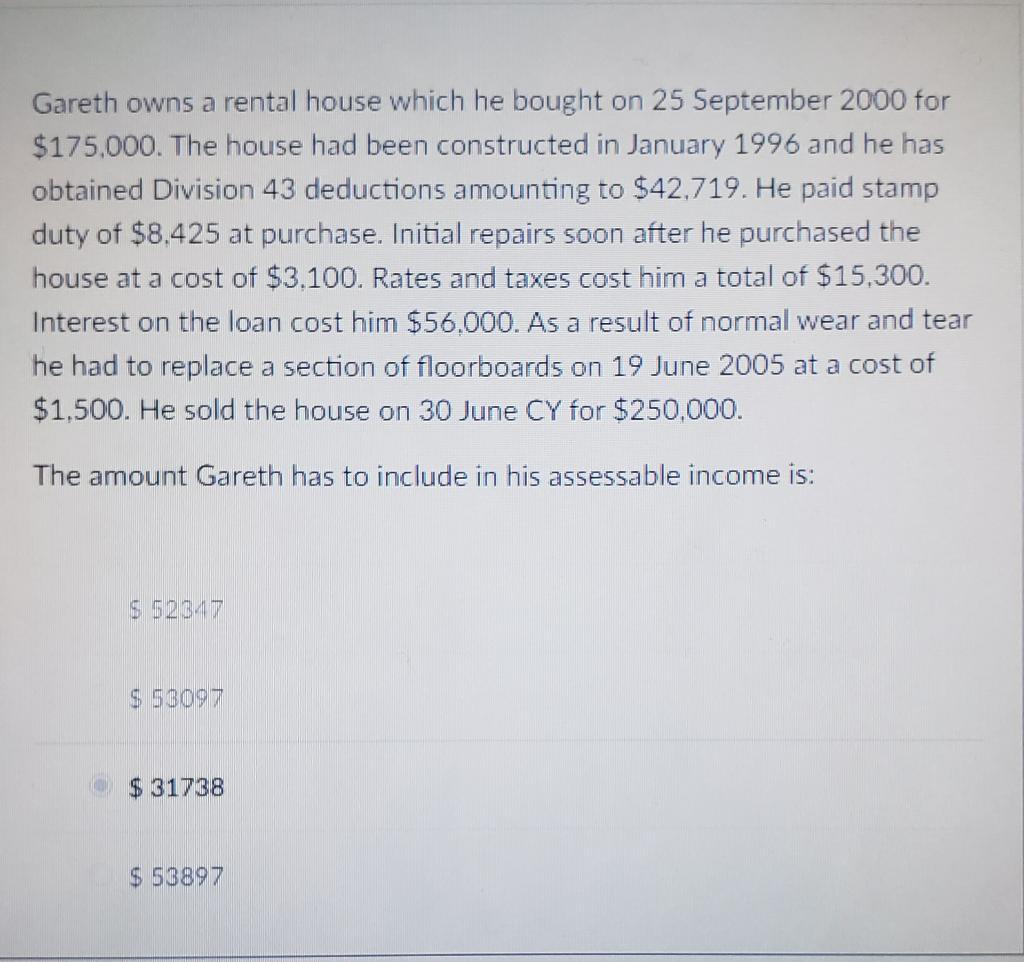

Gareth owns a rental house which he bought on 25 September 2000 for $175,000. The house had been constructed in January 1996 and he has obtained Division 43 deductions amounting to $42,719. He paid stamp duty of $8,425 at purchase. Initial repairs soon after he purchased the house at a cost of $3,100. Rates and taxes cost him a total of $15,300. Interest on the loan cost him $56,000. As a result of normal wear and tear he had to replace a section of floorboards on 19 June 2005 at a cost of $1,500. He sold the house on 30 June CY for $250,000. The amount Gareth has to include in his assessable income is: 552347 $53097 $31738 $53897

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts