Question: answer it please On January 2, 2018, Lexy and Ace dissolve their partnership and transfer all assets and liabilities to a newly formed corporation. At

answer it please

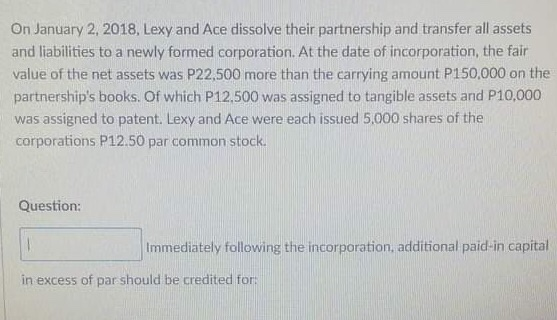

On January 2, 2018, Lexy and Ace dissolve their partnership and transfer all assets and liabilities to a newly formed corporation. At the date of incorporation, the fair value of the net assets was P22,500 more than the carrying amount P150,000 on the partnership's books. Of which P12,500 was assigned to tangible assets and P10,000 was assigned to patent. Lexy and Ace were each issued 5,000 shares of the corporations P12.50 par common stock. Question: Immediately following the incorporation, additional paid-in capital in excess of par should be credited for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock