Question: answer it they said b was wrong Chrome File Edit View History Bookmarks Profiles Tab Window Help Q 2 Sun Jun 15 11:09 AM ...

answer it they said b was wrong

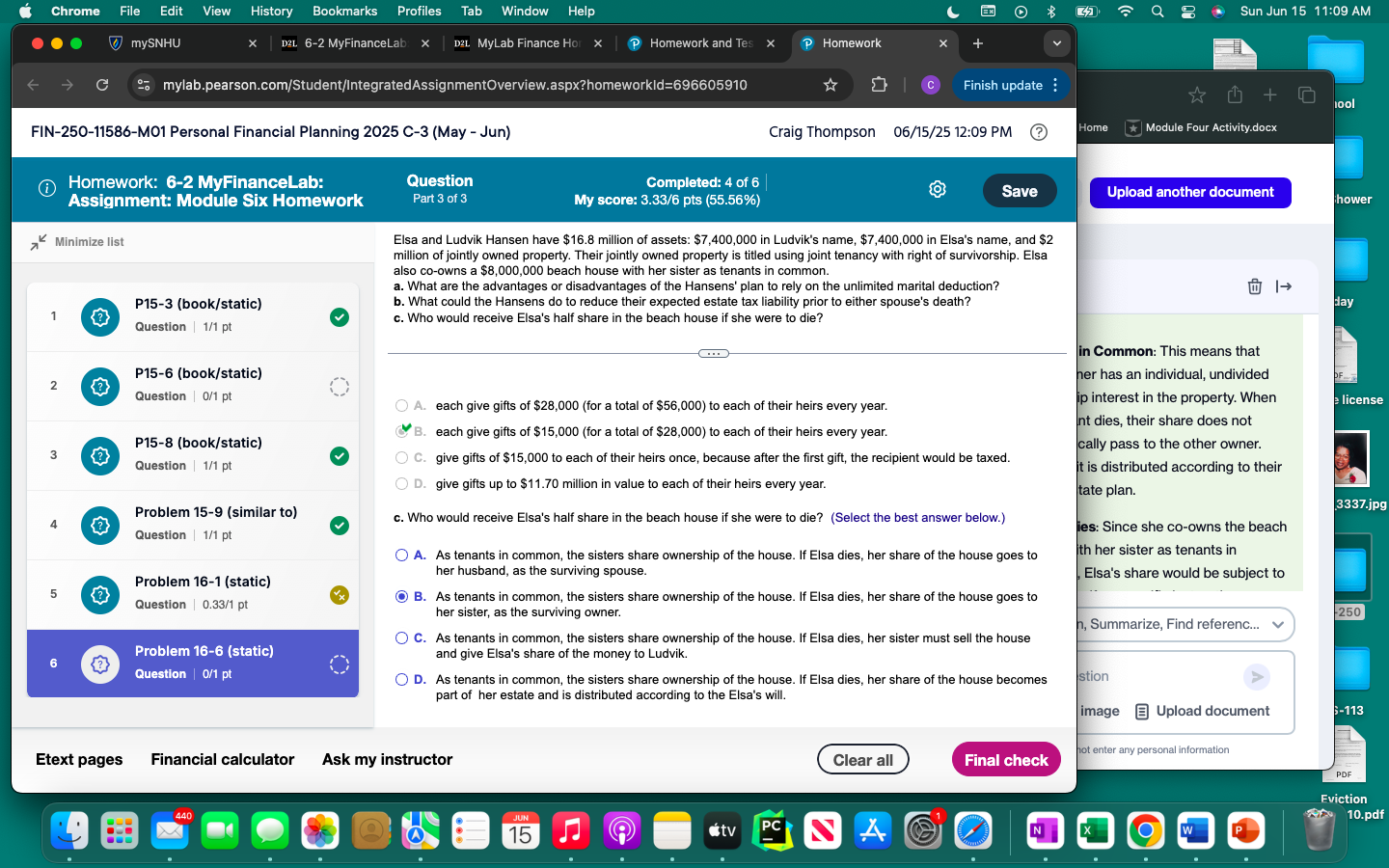

Chrome File Edit View History Bookmarks Profiles Tab Window Help Q 2 Sun Jun 15 11:09 AM ... mySNHU D21 6-2 MyFinanceLab: x D2L MyLab Finance Hor x Homework and Tes X Homework G @o mylab.pearson.com/Student/IntegratedAssignmentOverview.aspx?homeworkld=696605910 C Finish update : + lool FIN-250-11586-MO1 Personal Financial Planning 2025 C-3 (May - Jun) Craig Thompson 06/15/25 12:09 PM Home * Module Four Activity.docx Homework: 6-2 MyFinanceLab: Question Completed: 4 of 6 Assignment: Module Six Homework Part 3 of 3 My score: 3.33/6 pts (55.56%) Save Upload another document hower Minimize list Elsa and Ludvik Hansen have $16.8 million of assets: $7,400,000 in Ludvik's name, $7,400,000 in Elsa's name, and $2 million of jointly owned property. Their jointly owned property is titled using joint tenancy with right of survivorship. Elsa also co-owns a $8,000,000 beach house with her sister as tenants in common. a. What are the advantages or disadvantages of the Hansens' plan to rely on the unlimited marital deduction? P15-3 (book/static) b. What could the Hansens do to reduce their expected estate tax liability prior to either spouse's death? day Question | 1/1 pt c. Who would receive Elsa's half share in the beach house if she were to die? in Common: This means that P15-6 (book/static) her has an individual, undivided 2 Question | 0/1 pt O A. each give gifts of $28,000 (for a total of $56,000) to each of their heirs every year. ip interest in the property. When license nt dies, their share does not P15-8 (book/static) B. each give gifts of $15,000 (for a total of $28,000) to each of their heirs every year. cally pass to the other owner. Question | 1/1 pt O C. give gifts of $15,000 to each of their heirs once, because after the first gift, the recipient would be taxed. t is distributed according to their O D. give gifts up to $11.70 million in value to each of their heirs every year. tate plan. Problem 15-9 (similar to) 3337.jpg c. Who would receive Elsa's half share in the beach house if she were to die? (Select the best answer below.) lies: Since she co-owns the beach Question | 1/1 pt A. As tenants in common, the sisters share ownership of the house. If Elsa dies, her share of the house goes to th her sister as tenants in Problem 16-1 (static) her husband, as the surviving spouse Elsa's share would be subject to 5 V X Question | 0.33/1 pt O B. As tenants in common, the sisters share ownership of the house. If Elsa dies, her share of the house goes to her sister, as the surviving owner. 250 , Summarize, Find reference.. C. As tenants in common, the sisters share ownership of the house. If Elsa dies, her sister must sell the house Problem 16-6 (static) and give Elsa's share of the money to Ludvik. Question | 0/1 pt D. As tenants in common, the sisters share ownership of the house. If Elsa dies, her share of the house becomes stion part of her estate and is distributed according to the Elsa's will. image _ Upload document 5-113 ot enter any personal information Etext pages Financial calculator Ask my instructor Clear all Final check PDF Eviction 440 JUN 10.pdf 15 PC