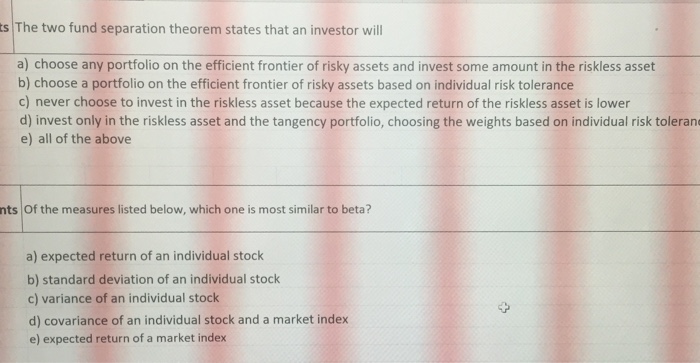

Question: Answer multiple choice s The two fund separation theorem states that an investor will a) choose any portfolio on the efficient frontier of risky assets

s The two fund separation theorem states that an investor will a) choose any portfolio on the efficient frontier of risky assets and invest some amount in the riskless asset b) choose a portfolio on the efficient frontier of risky assets based on individual risk tolerance c) never choose to invest in the riskless asset because the expected return of the riskless asset is lower d) invest only in the riskless asset and the tangency portfolio, choosing the weights based on individual risk toleran e) all of the above nts Of the measures listed below, which one is most similar to beta? a) expected return of an individual stock b) standard deviation of an individual stock c) variance of an individual stock d) covariance of an individual stock and a market index e) expected return of a market index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts