Question: answer need now 3. Consider the put and call option on XYZ stock maturing in December. The 35 exercise price call option sells for $4,

answer need now

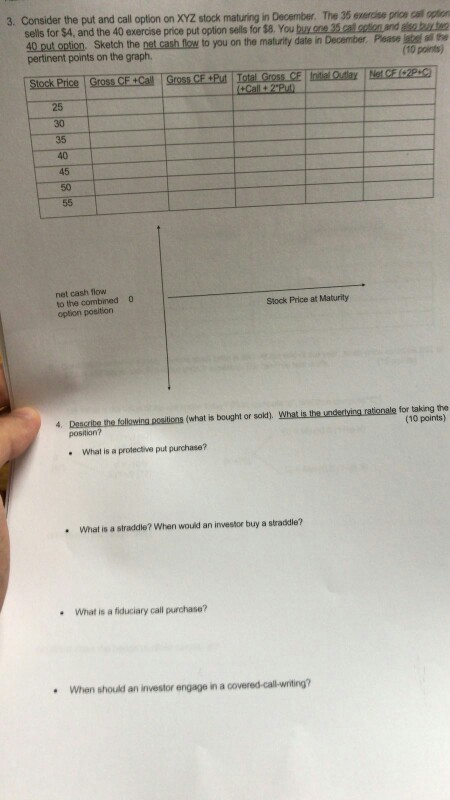

3. Consider the put and call option on XYZ stock maturing in December. The 35 exercise price call option sells for $4, and the 40 exercise price put option sells for $8. You buy one 35 call gtion and nbte 40 rut option Sketch the net cash flozg to you on the maturity date in ber Please atal pertirent points on the graph he (10 paints) Stock Price 25 30 35 40 45 50 net cash flow to the combined option positiorn Stock Price at Maturity (what is bought or sokd]. What is the underlying rationale for taking the (10 points) position? What is a protective put purchase? What is a straddle? When would an investor buy a straddle? What is a fiduciary call purchase? When should an investor engage in a covered-call-writing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts