Question: Answer needed for 7 and 8 only ASSESSMENT DESCRIPTION: Students are required to work in a group of 3 -5 students and must register for

Answer needed for 7 and 8 only

Answer needed for 7 and 8 only

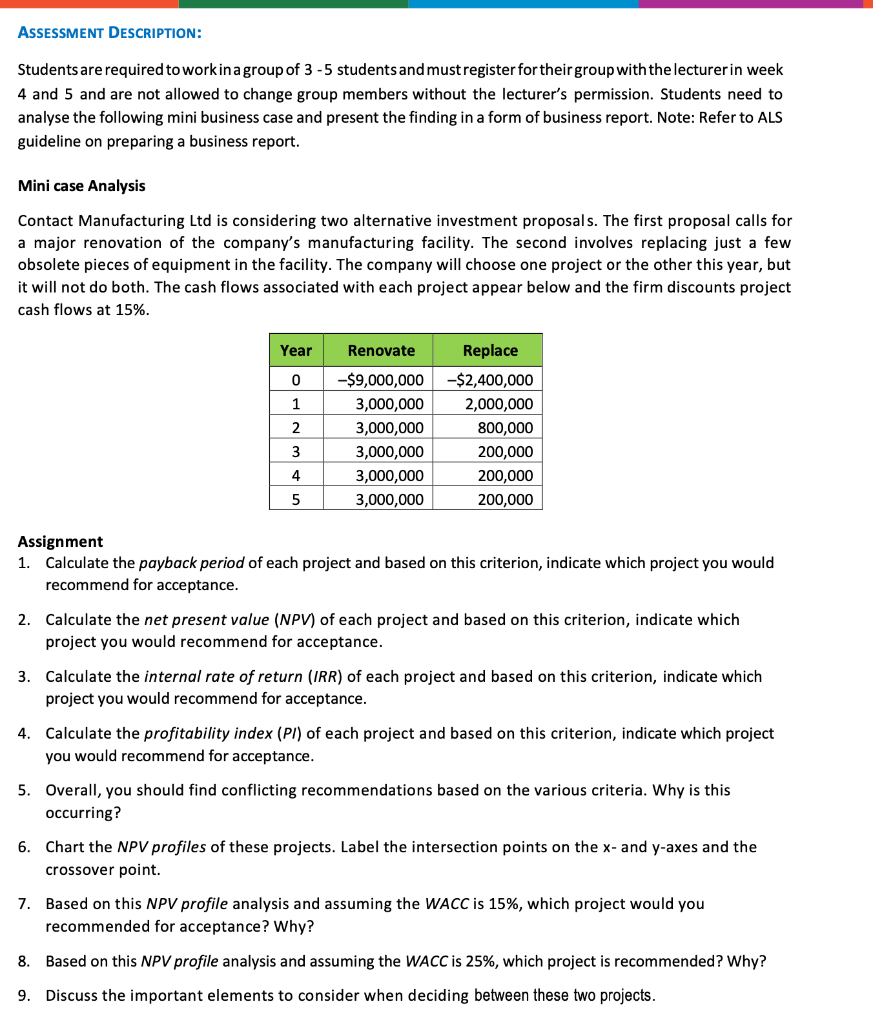

ASSESSMENT DESCRIPTION: Students are required to work in a group of 3 -5 students and must register for their group with the lecturer in week 4 and 5 and are not allowed to change group members without the lecturer's permission. Students need to analyse the following mini business case and present the finding in a form of business report. Note: Refer to ALS guideline on preparing a business report. Mini case Analysis Contact Manufacturing Ltd is considering two alternative investment proposals. The first proposal calls for a major renovation of the company's manufacturing facility. The second involves replacing just a few obsolete pieces of equipment in the facility. The company will choose one project or the other this year, but it will not do both. The cash flows associated with each project appear below and the firm discounts project cash flows at 15%. Year 0 1 2 Renovate Replace -$9,000,000 $2,400,000 3,000,000 2,000,000 3,000,000 800,000 3,000,000 200,000 3,000,000 200,000 3,000,000 200,000 3 4 5 Assignment 1. Calculate the payback period of each project and based on this criterion, indicate which project you would recommend for acceptance. 2. Calculate the net present value (NPV) of each project and based on this criterion, indicate which project you would recommend for acceptance. 3. Calculate the internal rate of return (IRR) of each project and based on this criterion, indicate which project you would recommend for acceptance. 4. Calculate the profitability index (PI) of each project and based on this criterion, indicate which project you would recommend for acceptance. 5. Overall, you should find conflicting recommendations based on the various criteria. Why is this occurring? 6. Chart the NPV profiles of these projects. Label the intersection points on the x- and y-axes and the crossover point. 7. Based on this NPV profile analysis and assuming the WACC is 15%, which project would you recommended for acceptance? Why? 8. Based on this NPV profile analysis and assuming the WACC is 25%, which project is recommended? Why? 9. Discuss the important elements to consider when deciding between these two projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts