Question: Answer: Net present value Profitability Index Internal rate of return 21 A small computer company is considering whether to add a new store near the

Answer:

Net present value

Profitability Index

Internal rate of return

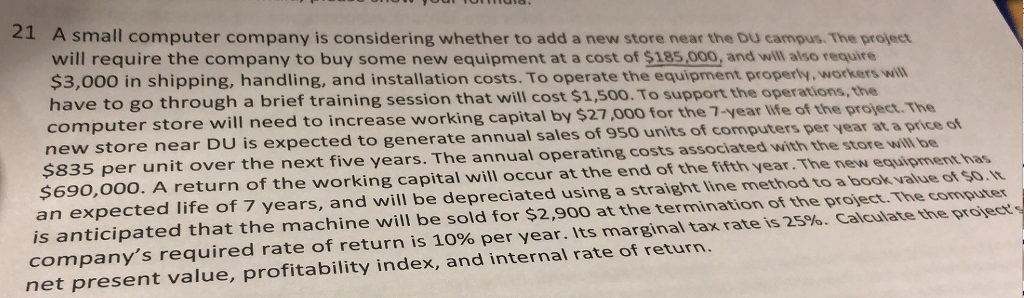

21 A small computer company is considering whether to add a new store near the DU campus. The project will require the company to buy some new equipment at a cost of $185,000, and will also require $3,000 in shipping, handling, and installation costs. To operate the equipment properly,workers will have to go through a brief training session that will cost s1,500. To support the operations, computer store will need to increase working capital by new store near DU $835 per unit over the next five years. The annual operating costs associated with the store will be $27,000 for the 7-year life of the project.The is expected to generate annual sales of 950 units of computers per year at a price of $690,00o. A return of the working capital will occur at the end of the fifth year.The new equipment has an expected life of 7 years, and will be depreciated using a straight line method to a book value of $o. is anticipated that the machine will be sold for $2,900 at the termination of the project. The computer company's required rate of return is 10% per year. Its marginal tax rate is 25%. Calculate the proyeces net present value, profitability index, and internal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts