Question: answer NO, 4, please Questions and Problems Solve for the price of a forward contract on a generic asset that expires on September 10 whose

answer NO, 4, please

answer NO, 4, please

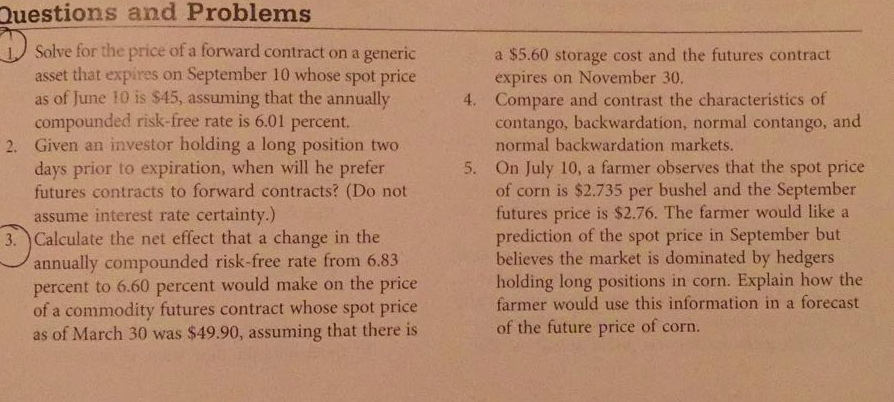

Questions and Problems Solve for the price of a forward contract on a generic asset that expires on September 10 whose spot price as of June 10 is $45, assuming that the annually compounded risk-free rate is 6.01 percent. a $5.60 storage cost and the futures contract expires on November 30 4. Compare and contrast the characteristics of contango, backwardation, normal contango, and normal backwardation markets. On July 10, a farmer observes that the spot price of corn is $2.735 per bushel and the September futures price is $2.76. The farmer would like a prediction of the spot price in September but believes the market is dominated by hedgers holding long positions in corn. Explain how the farmer would use this information in a forecast of the future price of corn 2. Given an investor holding a long position two days prior to expiration, when will he prefer futures contracts to forward contracts? (Do not assume interest rate certainty.) 5. 3. ) Calculate the net effect that a change in the annually compounded risk-free rate from 6.83 percent to 6.60 percent would make on the price of a commodity futures contract whose spot price as of March 30 was $49.90, assuming that there is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts