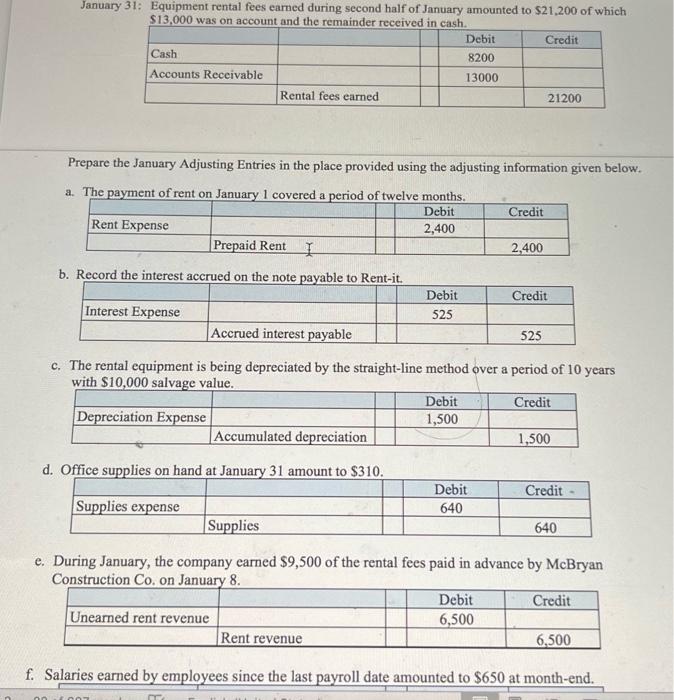

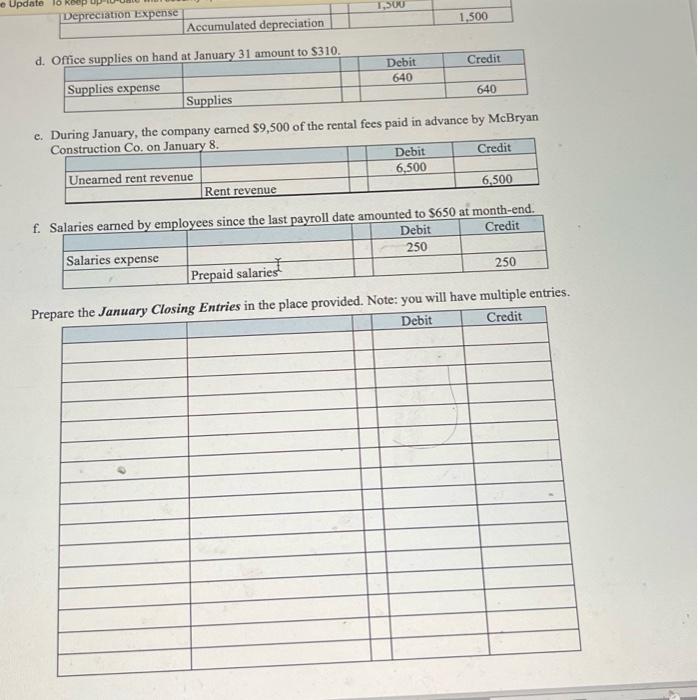

Question: answer number 7 using the table shown in the last photo *post to T accounts meaning? Instructions: 1) Prepare the journal entries for the January

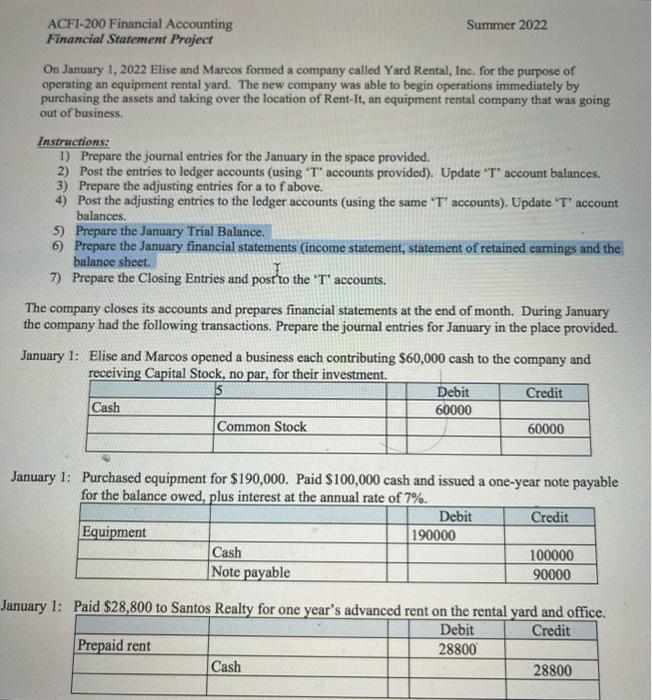

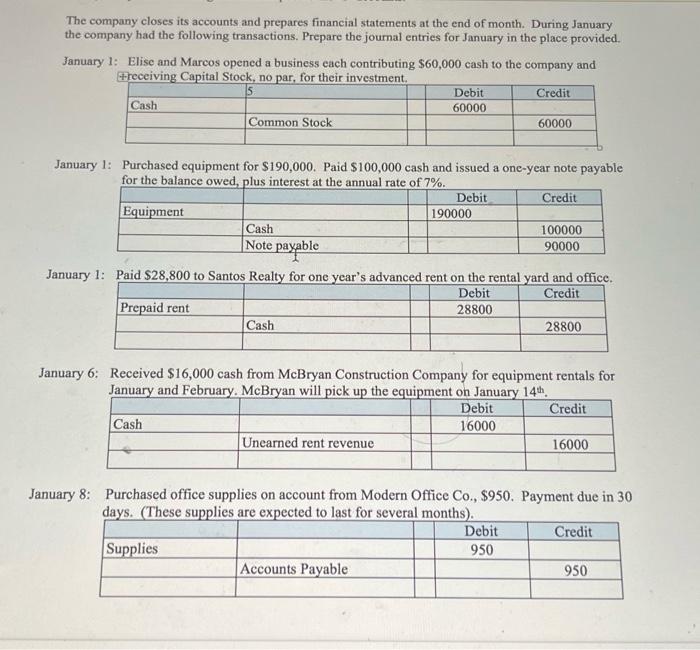

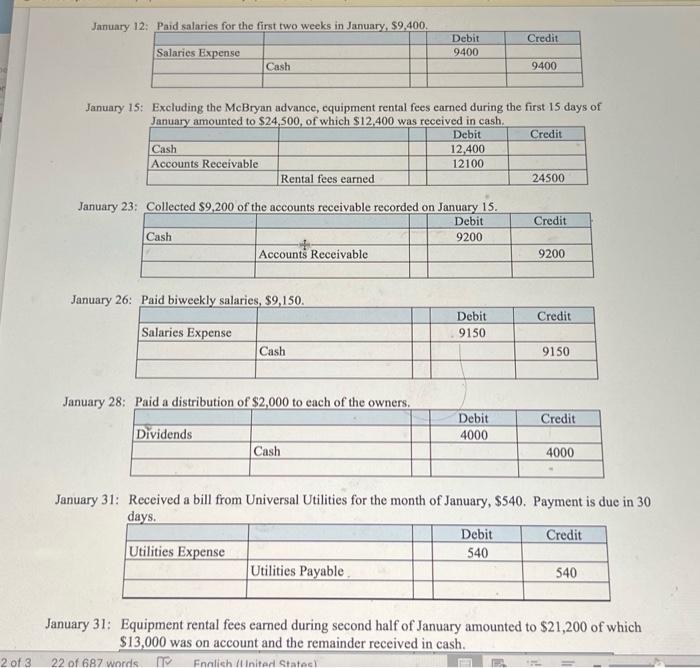

Instructions: 1) Prepare the journal entries for the January in the space provided. 2) Post the entries to ledger accounts (using ' T ' accounts provided). Update " T account balances. 3) Prepare the adjusting entries for a to f above. 4) Post the adjusting entries to the ledger accounts (using the same " T ' accounts). Update " T " account balances. 5) Prepare the January Trial Balance. 6) Prepare the January financial statements (income statement, statement of retained earnings and the balance sheet. 7) Prepare the Closing Entries and post to the ' T ' accounts. The company closes its accounts and prepares financial statements at the end of month. During January the company had the following transactions. Prepare the journal entries for January in the place provided. January 1: Elise and Marcos opened a business each contributing $60,000 cash to the company and receiving Capital Stock. no Dar. for their investment. nuary 1: Purchased equipment for $190,000. Paid $100,000 cash and issued a one-year note payable for the balance owed. plus interest at the annual rate of 7%. uary 1: Paid $28,800 to Santos Realty for one year's advanced rent on the rental vard and office. The company closes its accounts and prepares financial statements at the end of month. During January the company had the following transactions. Prepare the journal entries for January in the place provided. January 1: Elise and Marcos opened a business each contributing $60,000 cash to the company and receivine Canital Stock no nar. for their investmant January 1: Purchased equipment for $190,000. Paid $100,000 cash and issued a one-year note payable for the balance owed. plus interest at the annual rate of 7%. January 1: Paid $28,800 to Santos Realty for one year's advanced rent on the rental yard and office. January 6: Received $16,000 cash from McBryan Construction Company for equipment rentals for January and Februarv. McBrvan will nick un the equinment on Januarv 14th. January 8: Purchased office supplies on account from Modern Office Co., \$950. Payment due in 30 davs. (These supplies are expected to last for several months). January 15: Excluding the MeBryan advance, equipment rental fees earned during the first 15 days of January 23 January 26. Daid his.ant.1.. naloutan en 1 en January 28: Daid a dietrikution of eo n to assh of tha numane January 31: Received a bill from Universal Utilities for the month of January, $540. Payment is due in 30 davs. January 31: Equipment rental fees earned during second half of January amounted to $21,200 of which $13,000 was on account and the remainder received in cash. January 31: Equipment rental fees earned during second half of January amounted to $21,200 of which $13.000 was on account and the remainder receivas in cach Prepare the January Adjusting Entries in the place provided using the adjusting information given below. a. The payment of rent on Januarv 1 covered a neriod of twalva monthe b. c. The rental equipment is being depreciated by the straight-line method over a period of 10 years with $10.000 salvage value. d. Pffice cunnlies on hand at Tanuamr 21 amniust to 8210 e. During January, the company earned $9,500 of the rental fees paid in advance by McBryan Construction Co. on Januarv 8. f. Salaries earned by employees since the last payroll date amounted to $650 at month-end. d. e. Durino Januarv. the company carned $9,500 of the rental fees paid in advance by Mcuryan f. s P1 Instructions: 1) Prepare the journal entries for the January in the space provided. 2) Post the entries to ledger accounts (using ' T ' accounts provided). Update " T account balances. 3) Prepare the adjusting entries for a to f above. 4) Post the adjusting entries to the ledger accounts (using the same " T ' accounts). Update " T " account balances. 5) Prepare the January Trial Balance. 6) Prepare the January financial statements (income statement, statement of retained earnings and the balance sheet. 7) Prepare the Closing Entries and post to the ' T ' accounts. The company closes its accounts and prepares financial statements at the end of month. During January the company had the following transactions. Prepare the journal entries for January in the place provided. January 1: Elise and Marcos opened a business each contributing $60,000 cash to the company and receiving Capital Stock. no Dar. for their investment. nuary 1: Purchased equipment for $190,000. Paid $100,000 cash and issued a one-year note payable for the balance owed. plus interest at the annual rate of 7%. uary 1: Paid $28,800 to Santos Realty for one year's advanced rent on the rental vard and office. The company closes its accounts and prepares financial statements at the end of month. During January the company had the following transactions. Prepare the journal entries for January in the place provided. January 1: Elise and Marcos opened a business each contributing $60,000 cash to the company and receivine Canital Stock no nar. for their investmant January 1: Purchased equipment for $190,000. Paid $100,000 cash and issued a one-year note payable for the balance owed. plus interest at the annual rate of 7%. January 1: Paid $28,800 to Santos Realty for one year's advanced rent on the rental yard and office. January 6: Received $16,000 cash from McBryan Construction Company for equipment rentals for January and Februarv. McBrvan will nick un the equinment on Januarv 14th. January 8: Purchased office supplies on account from Modern Office Co., \$950. Payment due in 30 davs. (These supplies are expected to last for several months). January 15: Excluding the MeBryan advance, equipment rental fees earned during the first 15 days of January 23 January 26. Daid his.ant.1.. naloutan en 1 en January 28: Daid a dietrikution of eo n to assh of tha numane January 31: Received a bill from Universal Utilities for the month of January, $540. Payment is due in 30 davs. January 31: Equipment rental fees earned during second half of January amounted to $21,200 of which $13,000 was on account and the remainder received in cash. January 31: Equipment rental fees earned during second half of January amounted to $21,200 of which $13.000 was on account and the remainder receivas in cach Prepare the January Adjusting Entries in the place provided using the adjusting information given below. a. The payment of rent on Januarv 1 covered a neriod of twalva monthe b. c. The rental equipment is being depreciated by the straight-line method over a period of 10 years with $10.000 salvage value. d. Pffice cunnlies on hand at Tanuamr 21 amniust to 8210 e. During January, the company earned $9,500 of the rental fees paid in advance by McBryan Construction Co. on Januarv 8. f. Salaries earned by employees since the last payroll date amounted to $650 at month-end. d. e. Durino Januarv. the company carned $9,500 of the rental fees paid in advance by Mcuryan f. s P1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts