Question: ANSWER NUMBER 9 ONLY PLEASE!!!! ONLY NUMBER 9 08) Nina acquired a 75% controlling interest in Pinta in two stages. 1) In 2012, Nina acquired

ANSWER NUMBER 9 ONLY PLEASE!!!! ONLY NUMBER 9

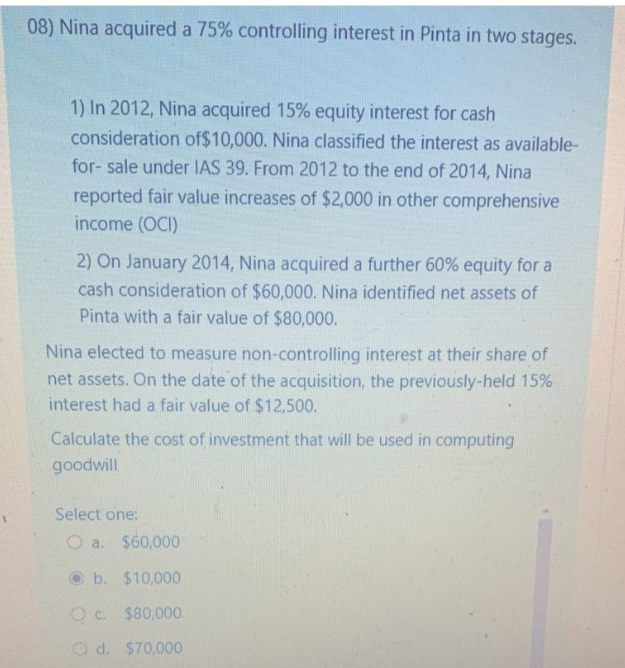

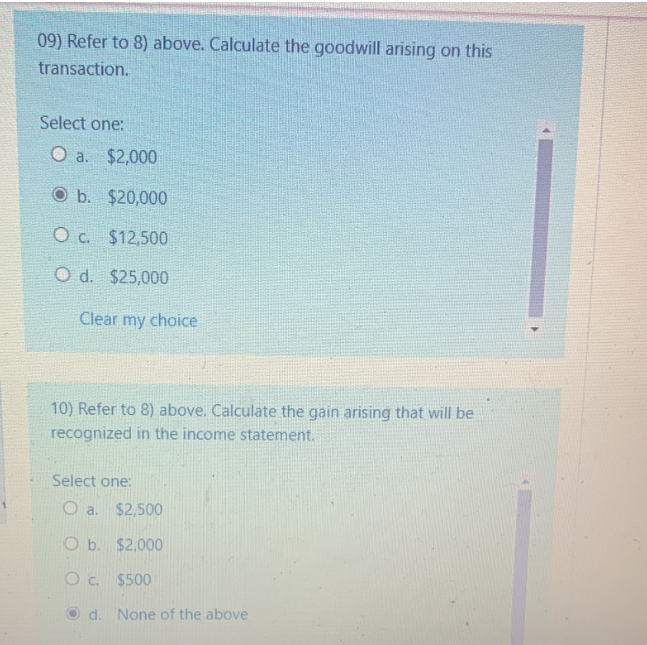

08) Nina acquired a 75% controlling interest in Pinta in two stages. 1) In 2012, Nina acquired 15% equity interest for cash consideration of $10,000. Nina classified the interest as availablefor- sale under IAS 39. From 2012 to the end of 2014, Nina reported fair value increases of $2,000 in other comprehensive income (OCl) 2) On January 2014, Nina acquired a further 60% equity for a cash consideration of $60,000. Nina identified net assets of Pinta with a fair value of $80,000. Nina elected to measure non-controlling interest at their share of net assets. On the date of the acquisition, the previously-held 15% interest had a fair value of $12,500. Calculate the cost of investment that will be used in computing goodwill Select one: a. $60,000 b. $10,000 c. $80,000 d. $70,000 09) Refer to 8) above. Calculate the goodwill arising on this transaction. Select one: a. $2,000 b. $20,000 c. $12,500 d. $25,000 Clear my choice 10) Refer to 8) above. Calculate the gain arising that will be recognized in the income statement. Select one: a. $2,500 b. $2,000 c. $500 d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts