Question: Answer numbers 1 to 4 in good accounting form. Problem 5-6 (PHILCPA Adapted) At the beginning of current year, Ulysses Company reported that the allowance

Answer numbers 1 to 4 in good accounting form.

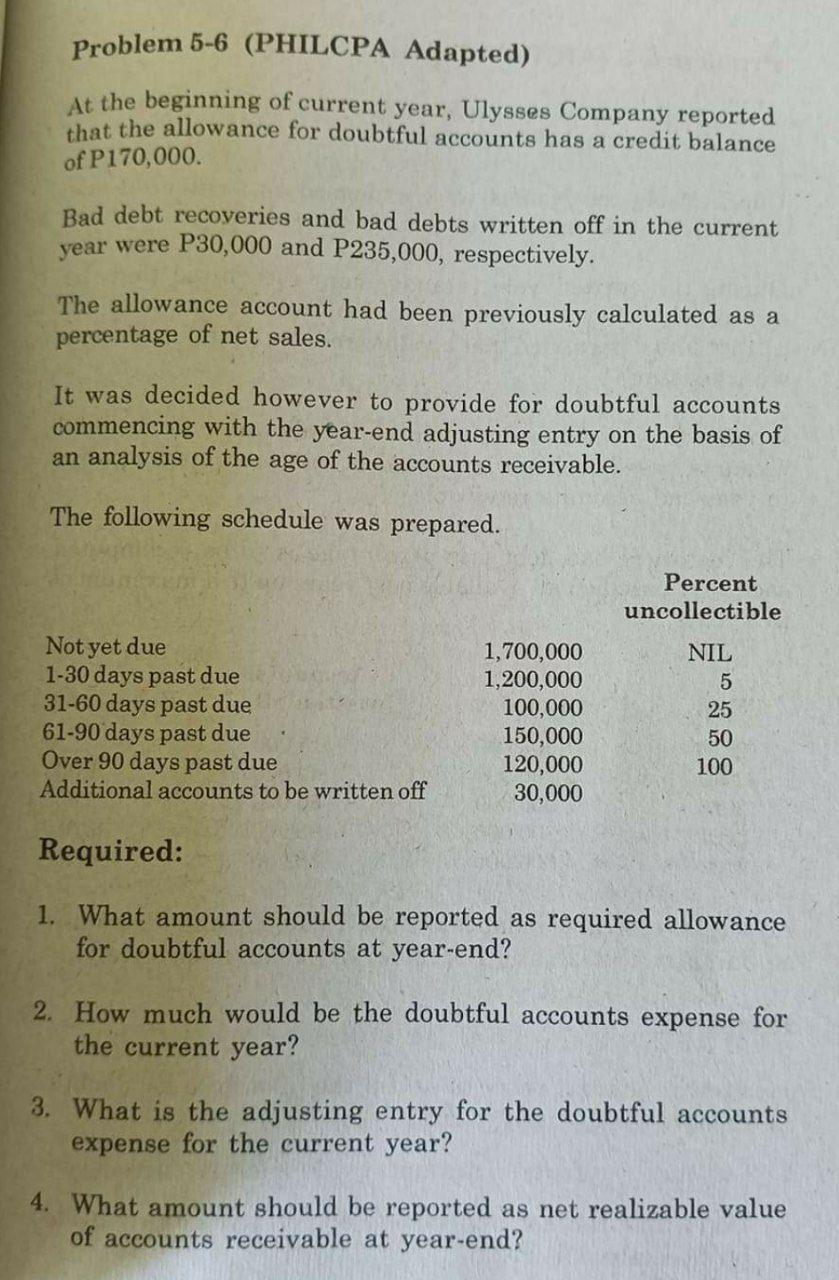

Problem 5-6 (PHILCPA Adapted) At the beginning of current year, Ulysses Company reported that the allowance for doubtful accounts has a credit balance of P170,000. Bad debt recoyeries and bad debts written off in the current year were P30,000 and P235,000, respectively. The allowance account had been previously calculated as a percentage of net sales. It was decided however to provide for doubtful accounts commencing with the year-end adjusting entry on the basis of an analysis of the age of the accounts receivable. The following schedule was prepared. Required: 1. What amount should be reported as required allowance for doubtful accounts at year-end? 2. How much would be the doubtful accounts expense for the current year? 3. What is the adjusting entry for the doubtful accounts expense for the current year? 4. What amount should be reported as net realizable value of accounts receivable at year-end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts