Question: answer on it For simplicity, VAT will not be taken into account in this examination subject. The same for Income taxes. * * * *

answer on it

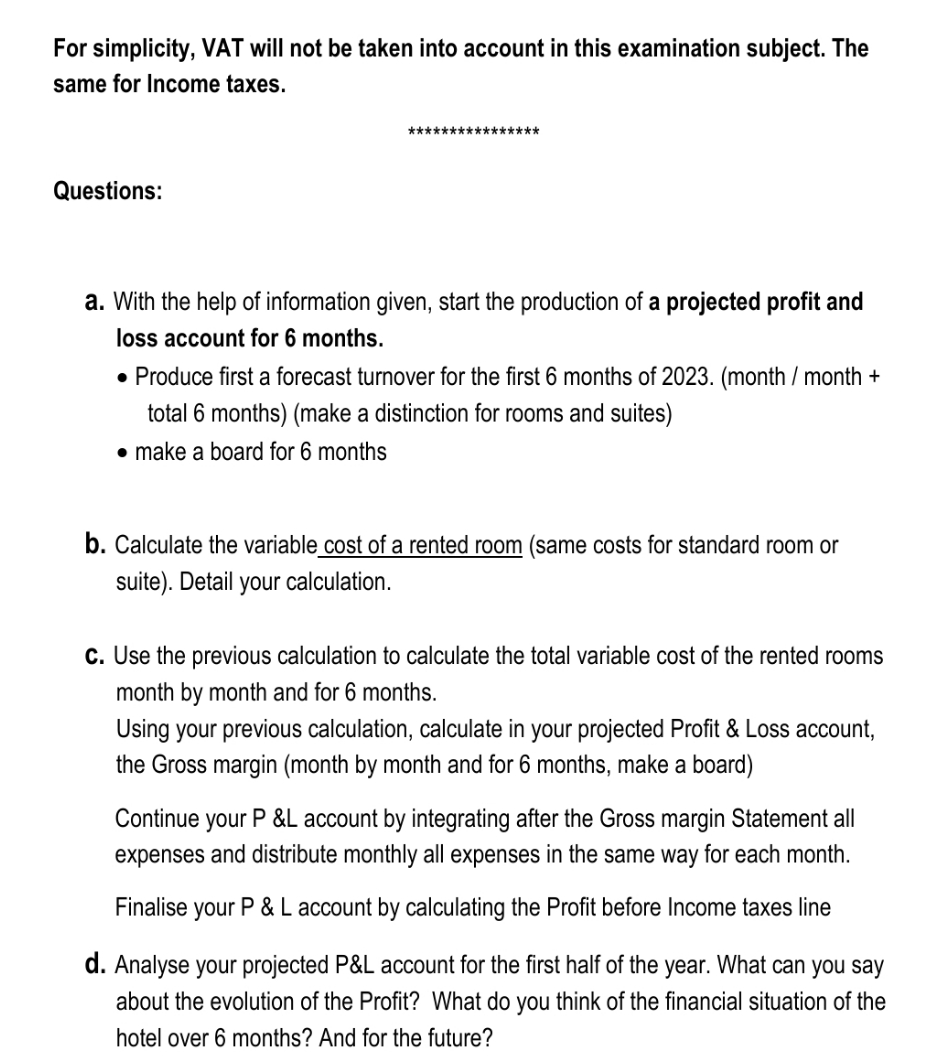

For simplicity, VAT will not be taken into account in this examination subject. The same for Income taxes. * * * * * * * * * * * * * * * * Questions: a. With the help of information given, start the production of a projected profit and loss account for 6 months. . Produce first a forecast turnover for the first 6 months of 2023. (month / month + total 6 months) (make a distinction for rooms and suites) . make a board for 6 months b. Calculate the variable cost of a rented room (same costs for standard room or suite). Detail your calculation. C. Use the previous calculation to calculate the total variable cost of the rented rooms month by month and for 6 months. Using your previous calculation, calculate in your projected Profit & Loss account, the Gross margin (month by month and for 6 months, make a board) Continue your P &L account by integrating after the Gross margin Statement all expenses and distribute monthly all expenses in the same way for each month. Finalise your P & L account by calculating the Profit before Income taxes line d. Analyse your projected P&L account for the first half of the year. What can you say about the evolution of the Profit? What do you think of the financial situation of the hotel over 6 months? And for the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts