Question: Answer ONE question from SECTION C (35 marks) Question 13(answer all parts) Burberry Group PLC is a British fashion clothing company. It is considering the

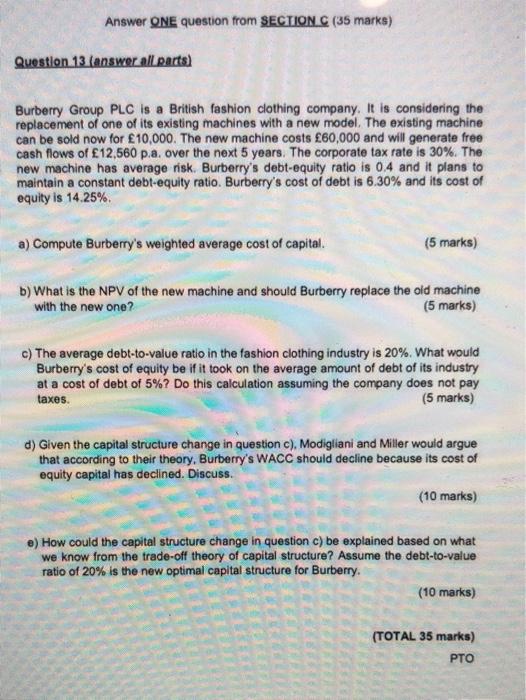

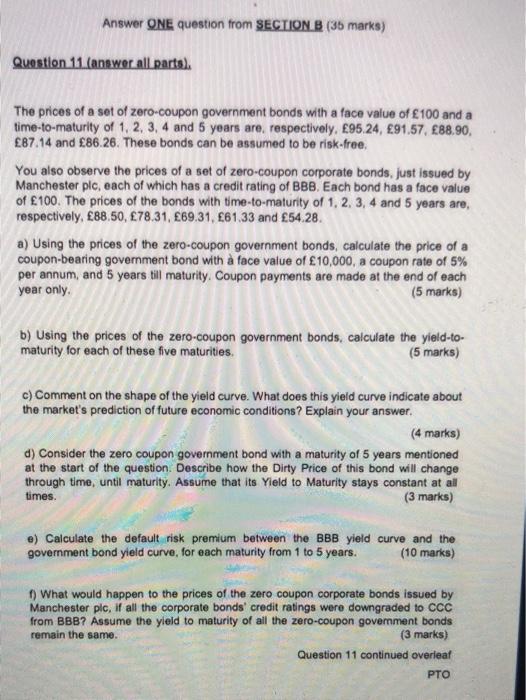

Answer ONE question from SECTION C (35 marks) Question 13(answer all parts) Burberry Group PLC is a British fashion clothing company. It is considering the replacement of one of its existing machines with a new model. The existing machine can be sold now for 10,000. The new machine costs 60,000 and will generate free cash flows of 12,560 p.a. over the next 5 years. The corporate tax rate is 30%. The new machine has average risk. Burberry's debt-equity ratio is 0.4 and it plans to maintain a constant debt-equity ratio. Burberry's cost of debt is 6.30% and its cost of equity is 14.25% a) Compute Burberry's weighted average cost of capital. (5 marks) b) What is the NPV of the new machine and should Burberry replace the old machine with the new one? (5 marks) c) The average debt-to-value ratio in the fashion clothing industry is 20%. What would Burberry's cost of equity be if it took on the average amount of debt of its industry at a cost of debt of 5%? Do this calculation assuming the company does not pay taxes (5 marks) d) Given the capital structure change in question c), Modigliani and Miler would argue that according to their theory, Burberry's WACC should decline because its cost of equity capital has declined. Discuss. (10 marks) e) How could the capital structure change in question c) be explained based on what we know from the trade-off theory of capital structure? Assume the debt-to-value ratio of 20% is the new optimal capital structure for Burberry. (10 marks) (TOTAL 35 marks) PTO Answer ONE question from SECTION B (36 marks) Question 11. (answer all parts), The prices of a set of zero-coupon government bonds with a face value of 100 and a time-to-maturity of 1, 2, 3, 4 and 5 years are, respectively, 95.24, 91.57, 88.90, 87.14 and 86.26. These bonds can be assumed to be risk-free, You also observe the prices of a set of zero-coupon corporate bonds, just issued by Manchester plc, each of which has a credit rating of BBB. Each bond has a face value of 100. The prices of the bonds with time-to-maturity of 1, 2, 3, 4 and 5 years are, respectively, 88.50, 78.31, 69.31. 61.33 and 54.28. a) Using the prices of the zero-coupon government bonds, calculate the price of a coupon-bearing government bond with a face value of 10,000, a coupon rate of 5% per annum, and 5 years till maturity. Coupon payments are made at the end of each year only (5 marks) b) Using the prices of the zero-coupon government bonds, calculate the yield-to- maturity for each of these five maturities. (5 marks) c) Comment on the shape of the yield curve. What does this yield curve indicate about the market's prediction of future economic conditions? Explain your answer. (4 marks) d) Consider the zero coupon government bond with a maturity of 5 years mentioned at the start of the question. Describe how the Dirty Price of this bond will change through time, until maturity. Assume that its Yield to Maturity stays constant at all times. (3 marks) e) Calculate the default risk premium between the BBB yield curve and the government bond yield curve, for each maturity from 1 to 5 years. (10 marks) What would happen to the prices of the zero coupon corporate bonds issued by Manchester plc, if all the corporate bonds' credit ratings were downgraded to CCC from BBB? Assume the yield to maturity of all the zero-coupon government bonds remain the same. (3 marks) Question 11 continued overleaf PTO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts