Question: answer only 3 please ! 3. Using the binomial model described in problem 1 except with N = 2, calculate the value (at time 0)

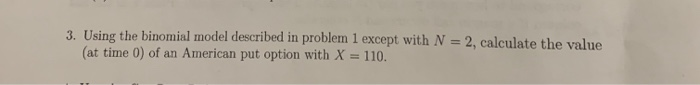

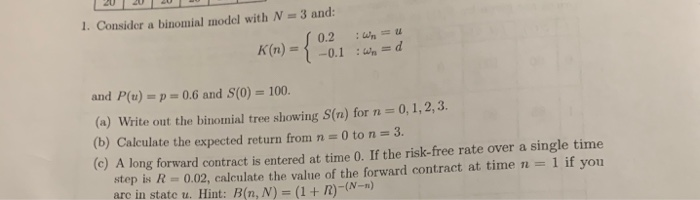

3. Using the binomial model described in problem 1 except with N = 2, calculate the value (at time 0) of an American put option with X = 110. 20 20 20 1. Consider a binomial model with N=3 and: 0.2 W = u K(n)-1 -0.1 : Wo=d and P(u) = p = 0.6 and S(0) = 100. (a) Write out the binomial tree showing S(n) for n = 0, 1, 2, 3. (b) Calculate the expected return from n = 0 ton = 3. (c) A long forward contract is entered at time 0. If the risk-free rate over a single time step is R -0.02, calculate the value of the forward contract at time n = 1 if you are in state u. Hint: Bn, N) = (1 + n)-(-) 3. Using the binomial model described in problem 1 except with N = 2, calculate the value (at time 0) of an American put option with X = 110. 20 20 20 1. Consider a binomial model with N=3 and: 0.2 W = u K(n)-1 -0.1 : Wo=d and P(u) = p = 0.6 and S(0) = 100. (a) Write out the binomial tree showing S(n) for n = 0, 1, 2, 3. (b) Calculate the expected return from n = 0 ton = 3. (c) A long forward contract is entered at time 0. If the risk-free rate over a single time step is R -0.02, calculate the value of the forward contract at time n = 1 if you are in state u. Hint: Bn, N) = (1 + n)-(-)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts