Question: answer only b, c, and d 1. (25 points) Consider another Pharmaceutical company, Big Pharma Inc. (BPI). BPI feels confident that they can produce a

answer only b, c, and d

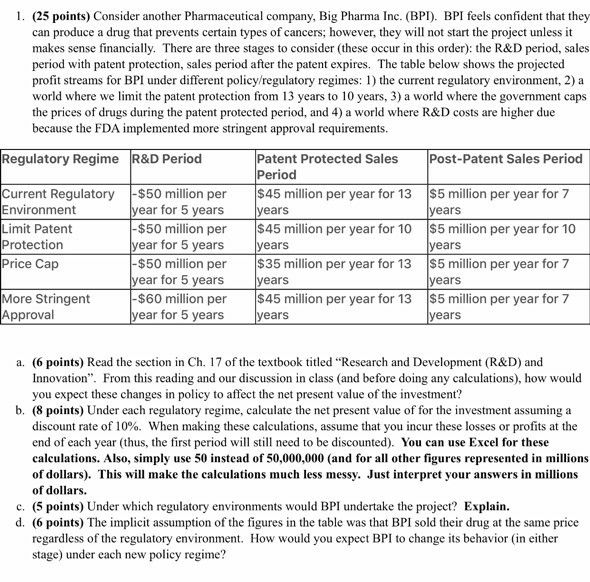

1. (25 points) Consider another Pharmaceutical company, Big Pharma Inc. (BPI). BPI feels confident that they can produce a drug that prevents certain types of cancers; however, they will not start the project unless it makes sense financially. There are three stages to consider (these occur in this order): the R&D period, sales period with patent protection, sales period after the patent expires. The table below shows the projected profit streams for BPI under different policy/regulatory regimes: 1) the current regulatory environment, 2) a world where we limit the patent protection from 13 years to 10 years, 3) a world where the government caps the prices of drugs during the patent protected period, and 4) a world where R&D costs are higher due because the FDA implemented more stringent approval requirements. Regulatory Regime R&D Period Post-Patent Sales Period Current Regulatory Environment Limit Patent Protection Price Cap -$50 million per year for 5 years - $50 million per year for 5 years - $50 million per year for 5 years -$60 million per year for 5 years Patent Protected Sales Period $45 million per year for 13 Jyears $45 million per year for 10 years $35 million per year for 13 years $45 million per year for 13 years $5 million per year for 7 years $5 million per year for 10 years $5 million per year for 7 years $5 million per year for 7 years More Stringent Approval a. (6 points) Read the section in Ch. 17 of the textbook titled "Research and Development (R&D) and Innovation". From this reading and our discussion in class and before doing any calculations), how would you expect these changes in policy to affect the net present value of the investment? b. (8 points) Under each regulatory regime, calculate the net present value of for the investment assuming a discount rate of 10%. When making these calculations, assume that you incur these losses or profits at the end of each year (thus, the first period will still need to be discounted). You can use Excel for these calculations. Also, simply use 50 instead of 50,000,000 (and for all other figures represented in millions of dollars). This will make the calculations much less messy. Just interpret your answers in millions of dollars. c. (5 points) Under which regulatory environments would BPI undertake the project? Explain. d. 6 points) The implicit assumption of the figures in the table was that BPI sold their drug at the same price regardless of the regulatory environment. How would you expect BPI to change its behavior in either stage) under each new policy regime

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts