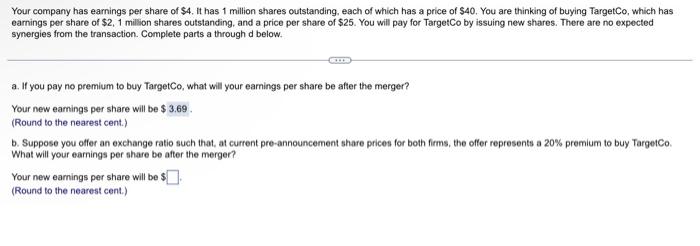

Question: answer only B please a Your company has earnings per share of $4. It has 1 million shares outstanding, each of which has a price

a Your company has earnings per share of $4. It has 1 million shares outstanding, each of which has a price of $40. You are thinking of buying TargetCo, which has earnings per share of $2,1 million shares outstanding, and a price per share of $25. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. Complete parts a through d below. a. If you pay no premium to buy TargetCo, what will your earnings per share be after the merger? Your new earnings per share will be $ 3.69 (Round to the nearest cent.) b. Suppose you offer an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 20% promlum to buy Targetco What will your earnings per share be after the merger? Your new earnings per share will be $ (Round to the nearest cont.) a Your company has earnings per share of $4. It has 1 million shares outstanding, each of which has a price of $40. You are thinking of buying TargetCo, which has earnings per share of $2,1 million shares outstanding, and a price per share of $25. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. Complete parts a through d below. a. If you pay no premium to buy TargetCo, what will your earnings per share be after the merger? Your new earnings per share will be $ 3.69 (Round to the nearest cent.) b. Suppose you offer an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 20% promlum to buy Targetco What will your earnings per share be after the merger? Your new earnings per share will be $ (Round to the nearest cont.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts