Question: Answer only History Bookmarks People Tab Window Help Part 2 ACFAR 1231 - SUMMAT X + ummati X Course: CONCEPTUAL FRAME X om/forms/d/e/1FAlpQLSfXdS5v2QZy10QFHKv5BF9K8DbuNkrHZpYGfgnjLIPVur_4RA/formResponse ~ Messenger

Answer only

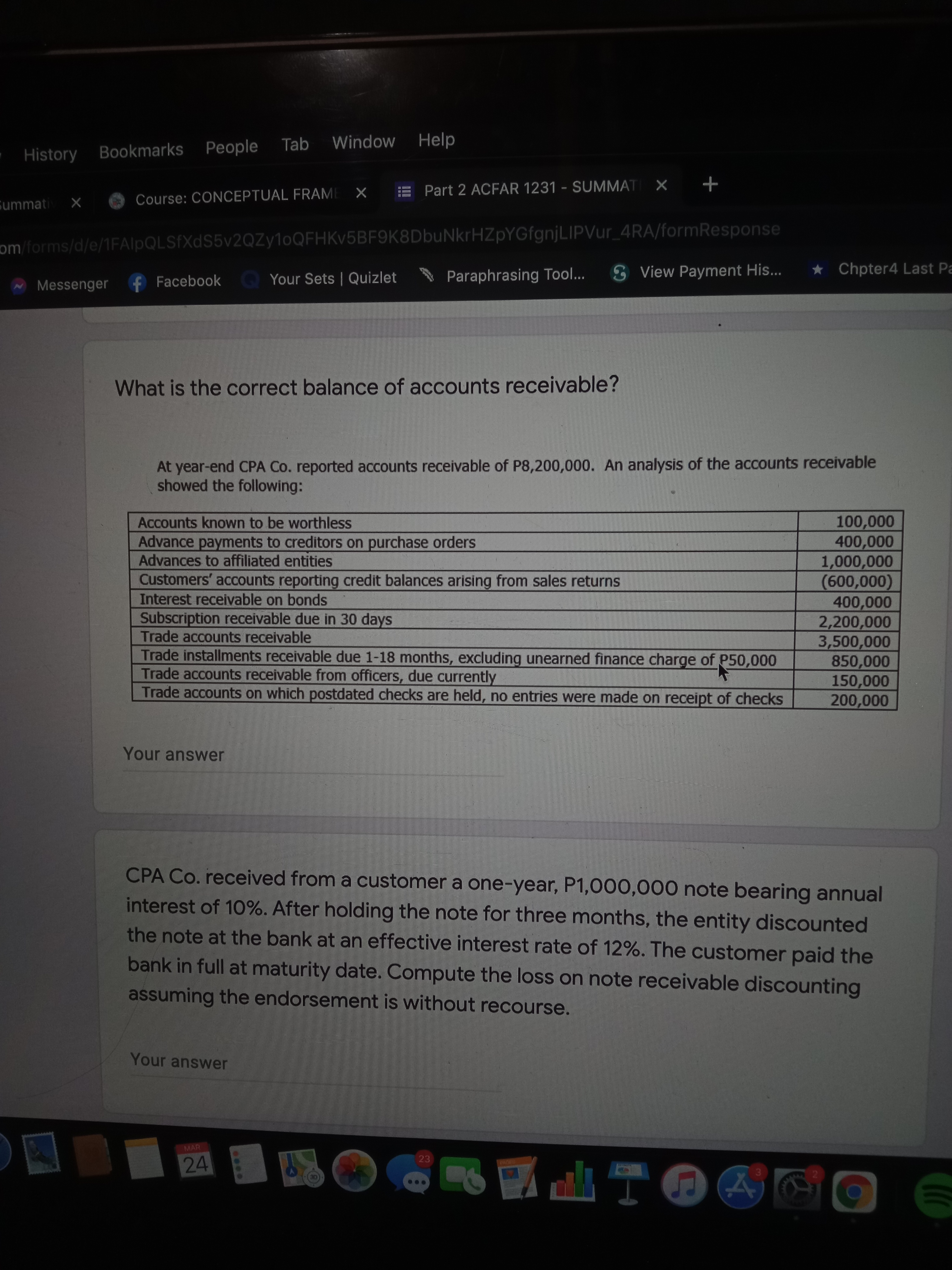

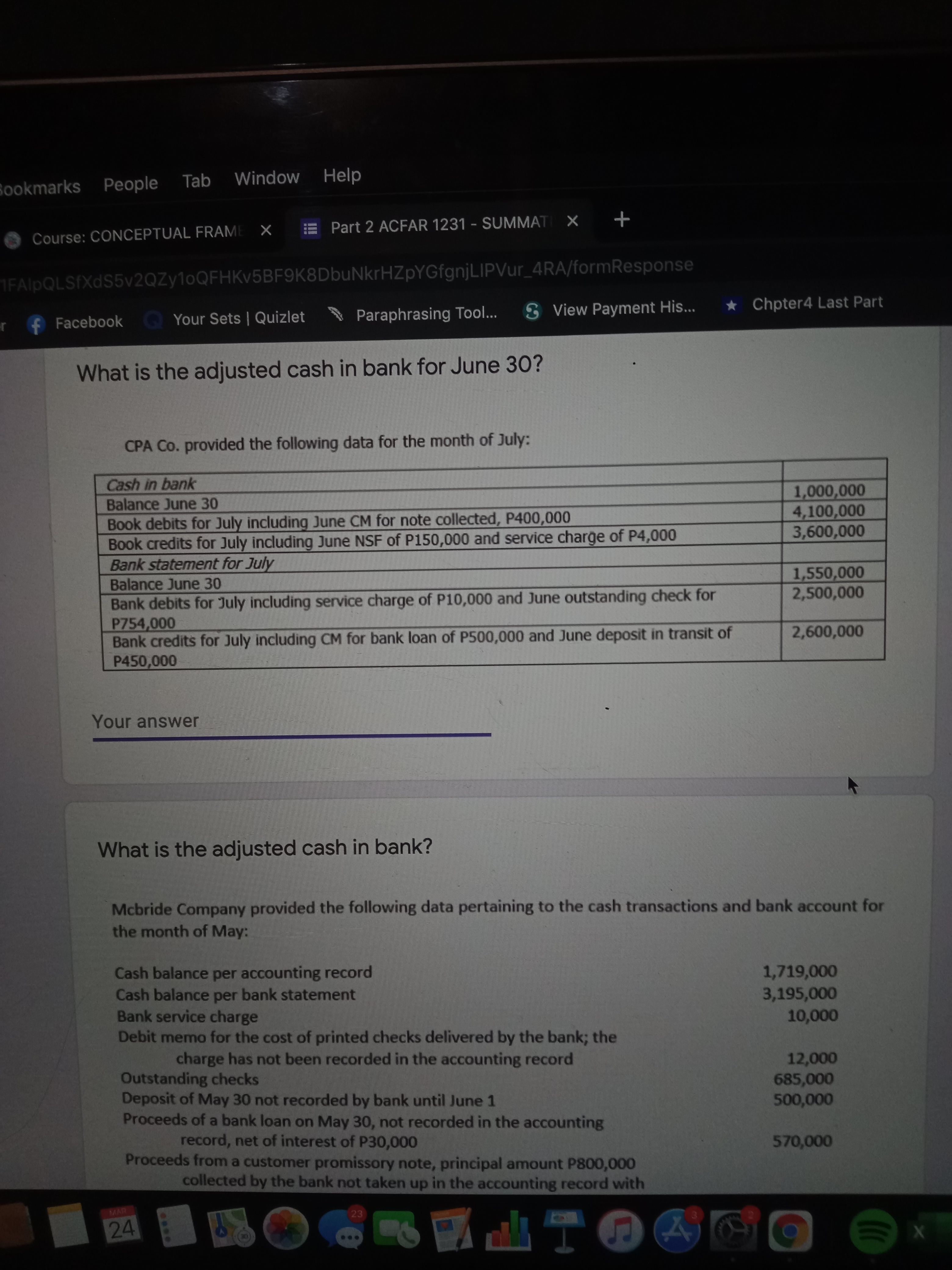

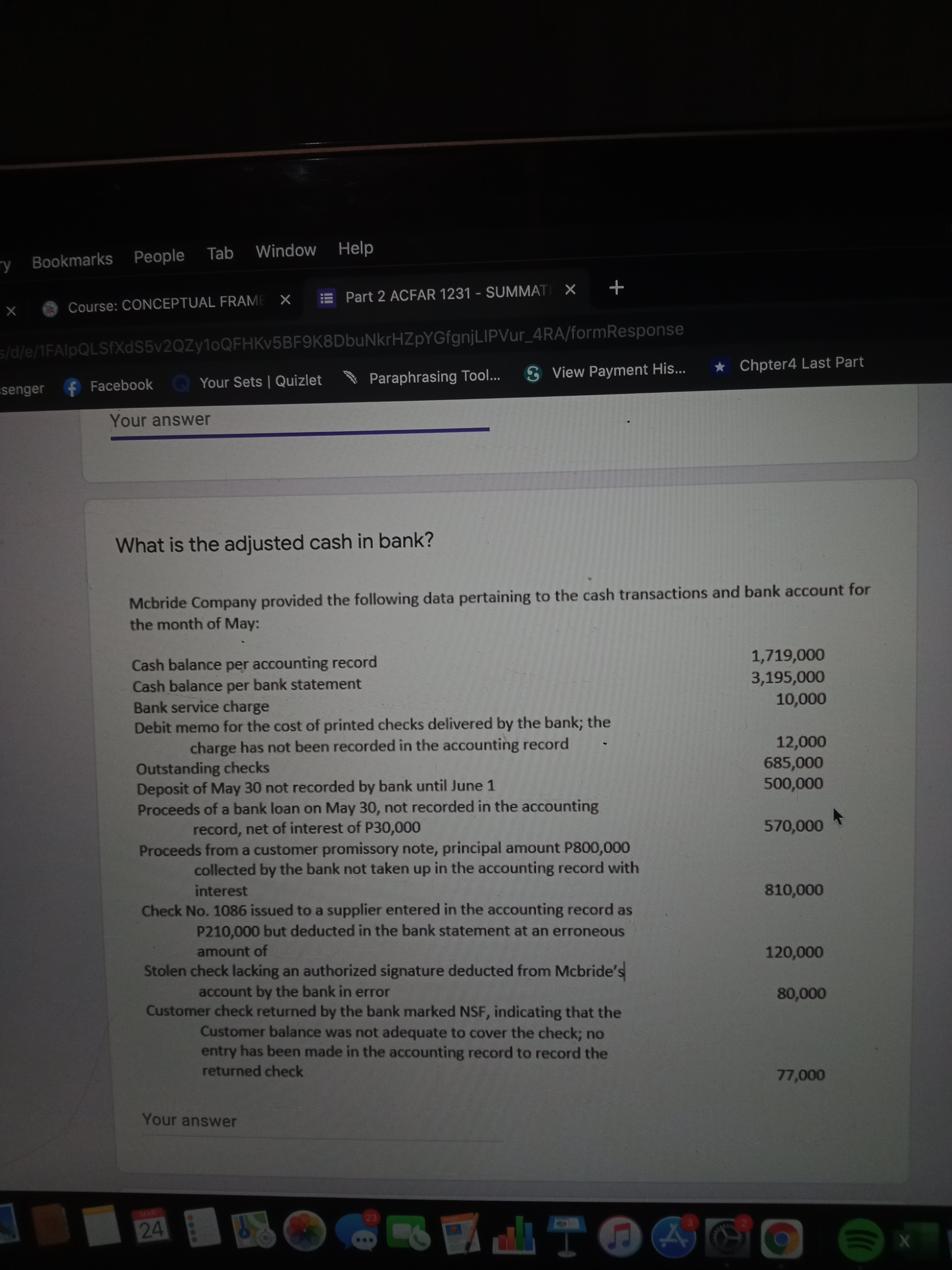

History Bookmarks People Tab Window Help Part 2 ACFAR 1231 - SUMMAT X + ummati X Course: CONCEPTUAL FRAME X om/forms/d/e/1FAlpQLSfXdS5v2QZy10QFHKv5BF9K8DbuNkrHZpYGfgnjLIPVur_4RA/formResponse ~ Messenger Facebook Your Sets | Quizlet Paraphrasing Tool... & View Payment His... Chpter4 Last P What is the correct balance of accounts receivable? At year-end CPA Co. reported accounts receivable of P8,200,000. An analysis of the accounts receivable showed the following: Accounts known to be worthless 100,000 Advance payments to creditors on purchase orders 400,000 Advances to affiliated entities 1,000,000 Customers' accounts reporting credit balances arising from sales returns 600,000) Interest receivable on bonds 400,000 Subscription receivable due in 30 days 2,200,000 Trade accounts receivable 3,500,000 Trade installments receivable due 1-18 months, excluding unearned finance charge of P50,000 850,000 Trade accounts receivable from officers, due currently 150,000 Trade accounts on which postdated checks are held, no entries were made on receipt of checks 200,000 Your answer CPA Co. received from a customer a one-year, P1,000,000 note bearing annual interest of 10%. After holding the note for three months, the entity discounted the note at the bank at an effective interest rate of 12%. The customer paid the bank in full at maturity date. Compute the loss on note receivable discounting assuming the endorsement is without recourse. Your answer 24 23Bookmarks People Tab Window Help Course: CONCEPTUAL FRAME X Part 2 ACFAR 1231 - SUMMAT X + IFAlpQLSfXdS5v2QZy10QFHKv5BF9K8DbuNkrHZpYGfgnjLIPVur_4RA/formResponse Facebook Your Sets | Quizlet Paraphrasing Tool... & View Payment His... *Chpter4 Last Part What is the adjusted cash in bank for June 30? CPA Co. provided the following data for the month of July: Cash in bank Balance June 30 1,000,000 Book debits for July including June CM for note collected, P400,000 4,100,000 Book credits for July including June NSF of P150,000 and service charge of P4,000 3,600,000 Bank statement for July Balance June 30 1,550,000 Bank debits for July including service charge of P10,000 and June outstanding check for 2,500,000 P754,000 Bank credits for July including CM for bank loan of P500,000 and June deposit in transit of 2,600,000 P450,000 Your answer What is the adjusted cash in bank? Mcbride Company provided the following data pertaining to the cash transactions and bank account for the month of May: Cash balance per accounting record 1,719,000 Cash balance per bank statement 3,195,000 Bank service charge 10,000 Debit memo for the cost of printed checks delivered by the bank; the charge has not been recorded in the accounting record Outstanding checks 12,000 685,000 Deposit of May 30 not recorded by bank until June 1 500,000 Proceeds of a bank loan on May 30, not recorded in the accounting record, net of interest of P30,000 570,000 Proceeds from a customer promissory note, principal amount P800,000 collected by the bank not taken up in the accounting record with 24Bookmarks People Tab Window Help Course: CONCEPTUAL FRAME X Part 2 ACFAR 1231 - SUMMAT X + X /d/e/1FAlpQLSfXdS5v2QZy10QFHKv5BF9K8DbuNkrHZpYGfgnjLIPVur_4RA/formResponse senger f Facebook Your Sets | Quizlet Paraphrasing Tool... & View Payment His... *Chpter4 Last Part Your answer What is the adjusted cash in bank? Mcbride Company provided the following data pertaining to the cash transactions and bank account for the month of May: Cash balance per accounting record 1,719,000 Cash balance per bank statement 3,195,000 Bank service charge 10,000 Debit memo for the cost of printed checks delivered by the bank; the charge has not been recorded in the accounting record 12,000 Outstanding checks 685,000 Deposit of May 30 not recorded by bank until June 1 500,000 Proceeds of a bank loan on May 30, not recorded in the accounting record, net of interest of P30,000 570,000 Proceeds from a customer promissory note, principal amount P800,000 collected by the bank not taken up in the accounting record with interest 810,000 Check No. 1086 issued to a supplier entered in the accounting record as P210,000 but deducted in the bank statement at an erroneous amount of 120,000 Stolen check lacking an authorized signature deducted from Mcbride's account by the bank in error 80,000 Customer check returned by the bank marked NSF, indicating that the Customer balance was not adequate to cover the check; no entry has been made in the accounting record to record the returned check 77,000 Your answer 24 23 9