Question: answer only if u know otherwise 10 downvotes straightway ILLUSTRATION 4 The following annual figures relate to XYZ Co., 36,00,000 9,00,000 7,20,005 9,60,000 Sales (at

answer only if u know otherwise 10 downvotes straightway

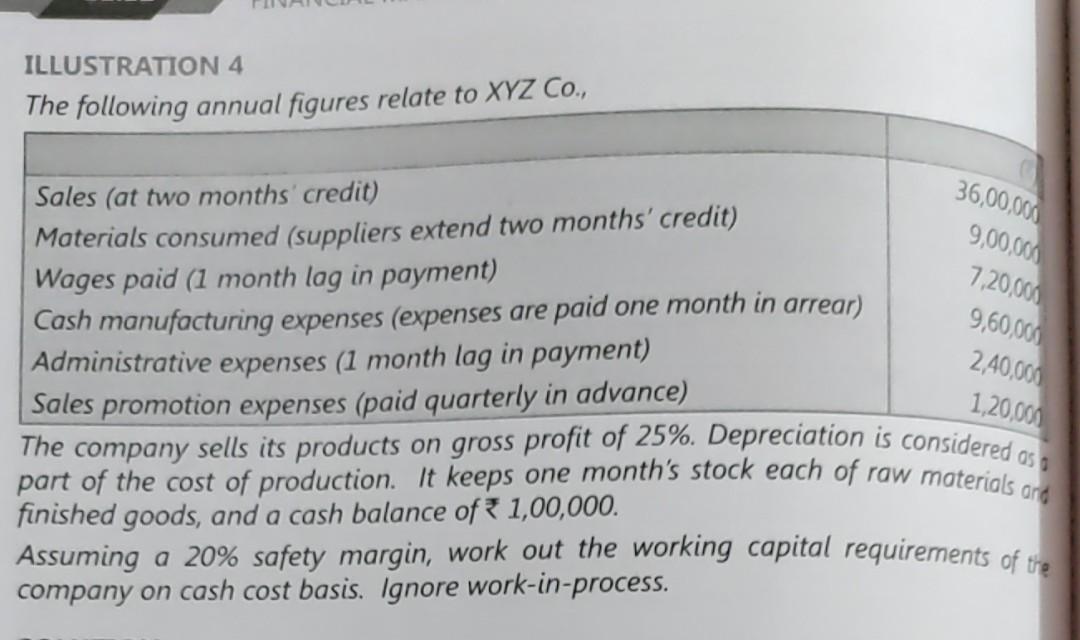

ILLUSTRATION 4 The following annual figures relate to XYZ Co., 36,00,000 9,00,000 7,20,005 9,60,000 Sales (at two months credit) Materials consumed (suppliers extend two months' credit) Wages paid (1 month lag in payment) Cash manufacturing expenses (expenses are paid one month in arrear) Administrative expenses (1 month lag in payment) The company sells its products on gross profit of 25%. Depreciation is considered as o Sales promotion expenses (paid quarterly in advance) part of the cost of production. It keeps one month's stock each of raw materials and finished goods, and a cash balance of 1,00,000. Assuming a 20% safety margin, work out the working capital requirements of the company on cash cost basis. Ignore work-in-process. 240,000 1,20,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts