Question: Assume that a firm is evaluating a potential foreign investment project. They believe there is substantial risk of expropriation of the project's assets by

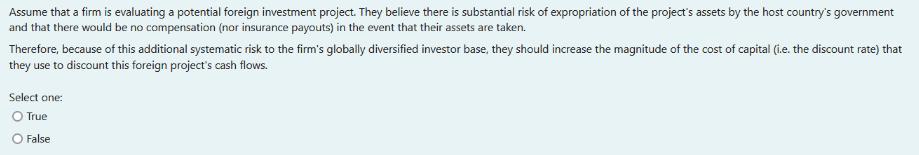

Assume that a firm is evaluating a potential foreign investment project. They believe there is substantial risk of expropriation of the project's assets by the host country's government and that there would be no compensation (nor insurance payouts) in the event that their assets are taken. Therefore, because of this additional systematic risk to the firm's globally diversified investor base, they should increase the magnitude of the cost of capital (i.e. the discount rate) that they use to discount this foreign project's cash flows. Select one: O True O False

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

False The higher the cost of capital the lower the present value of the cash flows from the ... View full answer

Get step-by-step solutions from verified subject matter experts