Question: answer only one and explain.. 1. What is the tax treatment of alimony and separate maintenance payments? How is it different for divorce agreements executed

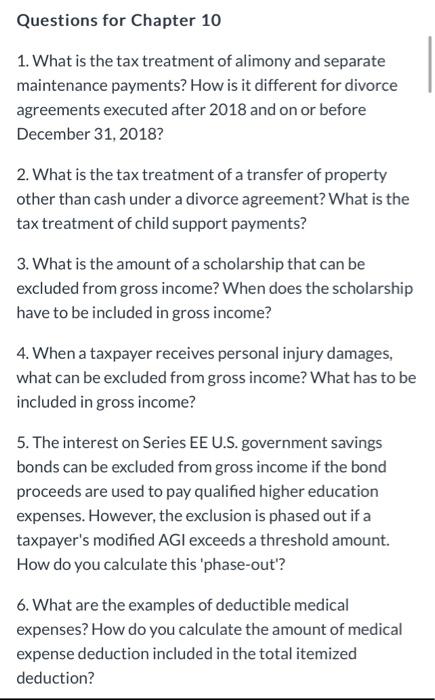

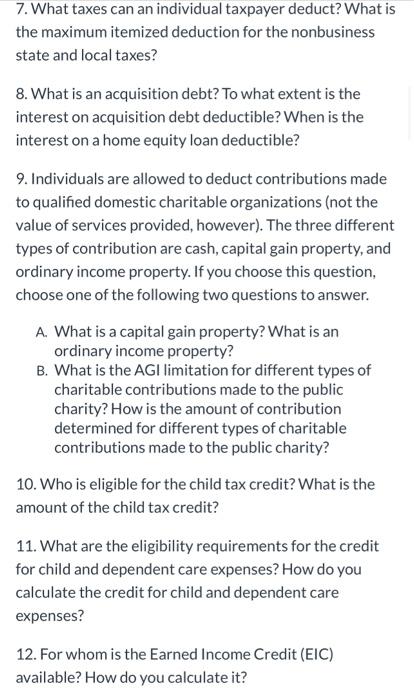

1. What is the tax treatment of alimony and separate maintenance payments? How is it different for divorce agreements executed after 2018 and on or before December 31,2018? 2. What is the tax treatment of a transfer of property other than cash under a divorce agreement? What is the tax treatment of child support payments? 3. What is the amount of a scholarship that can be excluded from gross income? When does the scholarship have to be included in gross income? 4. When a taxpayer receives personal injury damages, what can be excluded from gross income? What has to be included in gross income? 5. The interest on Series EE U.S. government savings bonds can be excluded from gross income if the bond proceeds are used to pay qualified higher education expenses. However, the exclusion is phased out if a taxpayer's modified AGI exceeds a threshold amount. How do you calculate this 'phase-out'? 6. What are the examples of deductible medical expenses? How do you calculate the amount of medical expense deduction included in the total itemized deduction? 7. What taxes can an individual taxpayer deduct? What is the maximum itemized deduction for the nonbusiness state and local taxes? 8. What is an acquisition debt? To what extent is the interest on acquisition debt deductible? When is the interest on a home equity loan deductible? 9. Individuals are allowed to deduct contributions made to qualified domestic charitable organizations (not the value of services provided, however). The three different types of contribution are cash, capital gain property, and ordinary income property. If you choose this question, choose one of the following two questions to answer. A. What is a capital gain property? What is an ordinary income property? B. What is the AGI limitation for different types of charitable contributions made to the public charity? How is the amount of contribution determined for different types of charitable contributions made to the public charity? 10. Who is eligible for the child tax credit? What is the amount of the child tax credit? 11. What are the eligibility requirements for the credit for child and dependent care expenses? How do you calculate the credit for child and dependent care expenses? 12. For whom is the Earned Income Credit (EIC) available? How do you calculate it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts