Question: ****ANSWER ONLY PLEASE **** ****ANSWER ONLY PLEASE **** ****ANSWER ONLY PLEASE **** 5. Problem 8-05 (Intrinsic Price per Share Based on FCFs) Intrinsic Price per

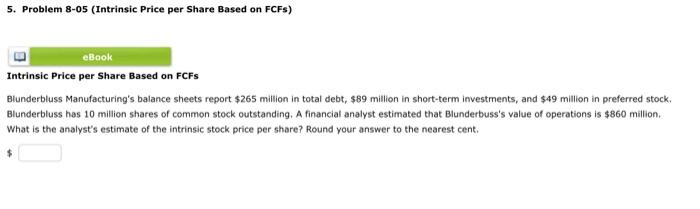

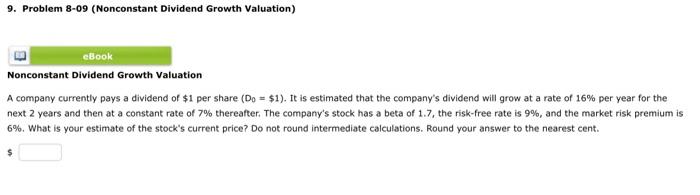

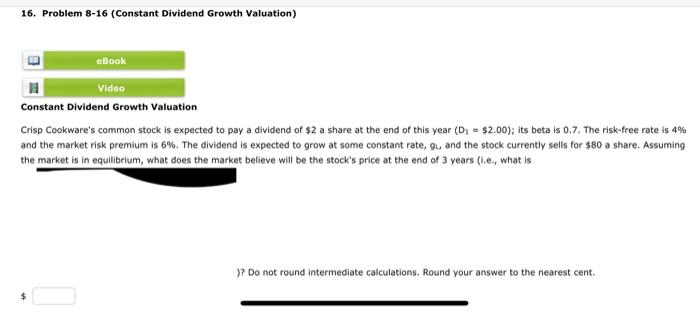

5. Problem 8-05 (Intrinsic Price per Share Based on FCFs) Intrinsic Price per Share Based on FCFs Blunderbluss Manufacturing's balance sheets report $265 million in total debt, $89 million in short-term investments, and $49 million in preferred stock. Blunderbluss has 10 million shares of common stock outstanding. A financial analyst estimated that Blunderbuss's value of operations is $860 million. What is the analyst's estimate of the intrinsic stock price per share? Round your answer to the nearest cent. 9. Problem 8-09 (Nonconstant Dividend Growth Valuation) Nonconstant Dividend Growth Valuation A company currently pays a dividend of $1 per share (D0=$1). It is estimated that the company's dividend will grow at a rate of 16% per year for the next 2 years and then at a constant rate of 7% thereafter. The company's stock has a beta of 1.7 , the risk-free rate is 9%, and the market risk premium is 6%. What is your estimate of the stock's current price? Do not round intermediate calculations. Round your answer to the nearest cent. $ 16. Problem 8-16 (Constant Dividend Growth Valuation) Constant Dividend Growth Valuation Crisp Cookware's common stock is expected to pay a dividend of $2 a share at the end of this year (D1=$2.00); its beta is 0.7 . The risk-free rate is 4% and the market risk premium is 6%. The dividend is expected to grow at some constant rate, 9L, and the stock currentiy sells for $80 a share. Assuming the market is in equilibrium, what does the market believe will be the stock's price at the end of 3 years (i.e., what is )? Do not round intermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts