Question: ANSWER ONLY. please only answer if you know answer to all of them. thank you QUESTION 1 10 points Consider a firm with $22.4 in

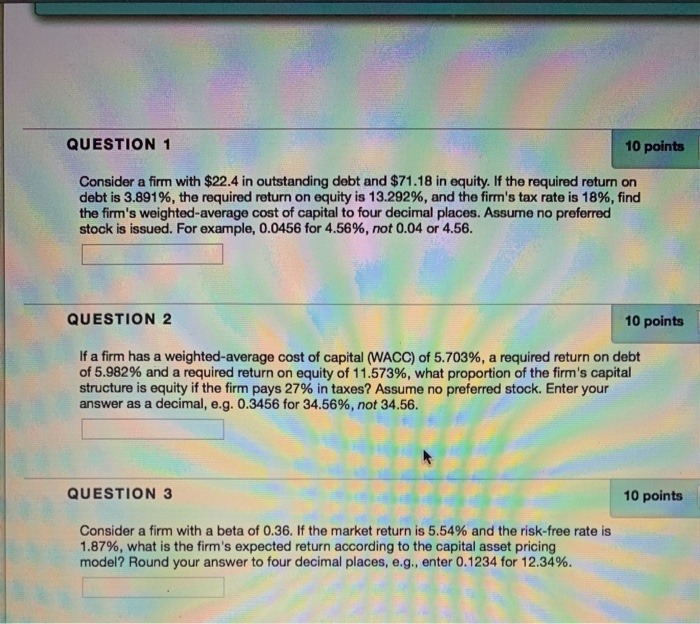

QUESTION 1 10 points Consider a firm with $22.4 in outstanding debt and $71.18 in equity. If the required return on debt is 3.891%, the required return on equity is 13.292%, and the firm's tax rate is 18%, find the firm's weighted average cost of capital to four decimal places. Assume no preferred stock is issued. For example, 0.0456 for 4.56%, not 0.04 or 4.56. QUESTION 2 10 points If a firm has a weighted average cost of capital (WACC) of 5.703%, a required return on debt of 5.982% and a required return on equity of 11.573%, what proportion of the firm's capital structure is equity if the firm pays 27% in taxes? Assume no preferred stock. Enter your answer as a decimal, e.g. 0.3456 for 34.56%, not 34.56. QUESTION 3 10 points Consider a firm with a beta of 0.36. If the market return is 5.54% and the risk-free rate is 1.87%, what is the firm's expected return according to the capital asset pricing model? Round your answer to four decimal places, e.g., enter 0.1234 for 12.34%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts